Financing a college education can be one of the most challenging hurdles for students and their families. While scholarships, grants, and federal loans provide significant help, they may not always cover the full cost of education. This is where personal (private) student loans come into play.

In this guide, we will delve into everything you need to know about taking out a private student loan, comparing it with federal loans, and providing practical advice to help you make informed financial decisions.

Understanding the Basics

Federal vs. Private Student Loans

Before diving into private student loans, it is crucial to understand how they differ from federal loans:

| Feature | Federal Loans | Private Loans |

| Interest Rates | Fixed, lower rates | Fixed or variable, often higher rates |

| Repayment Options | Flexible, income-driven plans | Less flexible, limited options |

| Eligibility | No credit check, no co-signer required | A credit check and/or co-signer may be required |

| Borrowing Limits | Lower, based on financial need | Higher, based on lender criteria |

Pros and Cons of Federal Loans:

- Pros: Lower interest rates, more repayment options, loan forgiveness programs.

- Cons: Borrowing limits may not cover the total cost of attendance.

Pros and Cons of Private Loans:

- Pros: Higher borrowing limits, potentially faster approval.

- Cons: Stricter credit requirements, less flexible repayment terms.

What is a Private Student Loan?

A private student loan is a non-federal loan offered by banks, credit unions, or other financial institutions. These loans are designed to help students cover costs not met by other forms of financial aid.

- Who Offers Them: Private lender loans are provided by banks, online lenders, and credit unions. Some students may also consider personal loans for good credit or private loans for business if they are pursuing education related to entrepreneurship.

- When to Consider Them: Private loans are typically considered after you have exhausted federal loan options or need additional funding for specialized programs or living expenses. For example, international students might explore international student loans without cosigner requirements, while U.S. students with strong credit may seek pre-approved personal loans or loans from a personal loan broker.

- Special Features: Some private loans offer options like income-based repayment private student loans, though these are less common than with federal loans. Students attending private institutions might also look into private scholarships or private school financial aid as alternatives.

- Flexibility in Use: Beyond tuition, a personal loan to start a business or even a Micro business lending option might be available to entrepreneurial students. For those exploring broader financial strategies, comparing a personal loan vs a line of credit can help determine the best approach.

- No-Cosigner Options: While many private loans require a co-signer, there are No cosigner student loans available for those with excellent credit or specialized circumstances. These are particularly useful for international or independent students.

By understanding the private loans definition and evaluating all related financial options—including long-term funding like long-term business loans or short-term solutions like personal loans—students can tailor their borrowing strategy to their unique needs.

Common Terminology

| Term | Definition |

| Principal | The original amount borrowed. |

| Interest | The cost of borrowing money is expressed as a percentage of the principal. |

| APR | A comprehensive measure of loan costs, including interest and fees. |

| Grace Period | The time after graduation before loan repayment begins. |

| Deferment/Forbearance | Temporary pauses on payments due to financial hardship or other qualifying conditions. |

Preparing to Take Out a Private Student Loan

Assess Your Financial Need

- Calculate the Total Cost of Attendance: Include tuition, fees, books, supplies, housing, and other living expenses.

- Evaluate Your Financial Aid: Determine the amount covered by scholarships, grants, and federal loans.

- Calculate the Gap: Identify how much you need to borrow to cover remaining expenses.

Visualization of Typical Costs

A bar graph showing typical college costs (e.g., tuition, housing, books, and personal expenses) can help visualize how these expenses add up.

Check Your Credit Score

Your credit score plays a vital role in securing a private loan with favorable terms.

| Credit Score Range | Impact on Loan Approval |

| 750+ | Excellent; lower interest rates |

| 700-749 | Good; favorable terms likely |

| 650-699 | Fair; may face higher interest |

| Below 650 | Poor; may require a co-signer |

- Why It Matters: A higher credit score can lower your interest rate.

- How to Check: Use free credit score tools or annualcreditreport.com.

- Improving Your Score: Pay bills on time, reduce outstanding debts, and correct errors on your credit report.

Explore Alternatives

Before opting for private loans, consider:

- Scholarships and Grants: Many organizations offer merit-based or need-based awards.

- Work-Study Programs: Earn money while attending school.

- Part-Time Work: Supplement income to reduce borrowing.

Co-Signer Considerations

A co-signer can increase your chances of loan approval and better terms.

| Advantages | Disadvantages |

| Easier approval | Co-signer shares responsibility |

| Lower interest rates | May strain personal relationships |

| Can improve credit score | Co-signers credit can be impacted |

The Loan Application Process

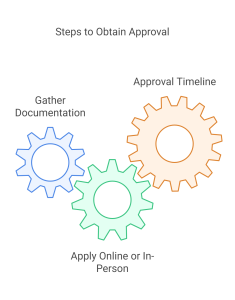

Step-by-Step Guide

- Gather Documentation:

- Proof of enrollment

- Identification (e.g., driver’s license or passport)

- Financial information (e.g., income statements, tax returns)

- Apply Online or In-Person: Most lenders offer user-friendly online applications. However, some local credit unions may require in-person visits.

- Approval Timeline: Depending on the lender, approval can take anywhere from a few minutes to several weeks.

Comparing Loan Offers

| Criteria | Fixed Rates | Variable Rates |

| Interest Rate | Consistent throughout term | Fluctuates with market rates |

| Predictability | High | Low |

| Risk | Lower | Higher |

- Fees: Check for origination fees or prepayment penalties.

- Repayment Terms: Analyze monthly payment amounts, loan term lengths, and any available repayment flexibility.

Managing Your Student Loan

Repayment Strategies

Example Monthly Payment Chart

| Loan Amount | Interest Rate | Repayment Term | Monthly Payment |

| $10,000 | 5% | 10 years | $106 |

| $20,000 | 7% | 10 years | $232 |

| $30,000 | 9% | 15 years | $304 |

- Income-Driven Repayment Plans: Explore options if your income is low.

- Extra Payments: Making additional payments can reduce the total interest paid.

- Refinancing: Consider refinancing to secure a lower interest rate.

- Avoid Late Payments: Late payments can negatively impact your credit score.

Long-Term Financial Planning

- Credit Score Impact: Timely payments build credit, while late payments harm it.

- Financial Goals: Balance loan repayment with other goals like saving for a home or retirement.

- Budgeting Tips:

- Track expenses to avoid overspending.

- Allocate a portion of your income to an emergency fund.

Additional Insights and Tools

Expert Advice

Financial advisors recommend considering long-term career earnings when deciding how much to borrow. Choose a loan amount that aligns with your expected income after graduation.

Personal Stories

Consider this case study:

- Success Story: A student borrowed $20,000, worked part-time, and paid off the loan within five years by making extra payments.

- Pitfall to Avoid: Another student took out $50,000 but struggled due to high interest rates and missed payments, which impacted their credit.

Interactive Loan Calculator

Use tools to calculate:

- Monthly payments for different loan amounts and interest rates.

- Total repayment costs over the loan term.

Checklists and Worksheets

Downloadable resources:

- Loan application checklist.

- Budgeting worksheet to manage expenses.

Conclusion

Ready to make smart financial moves for your education? Visit Wealthopedia to explore your federal aid options, calculate your financial needs, and find reputable private lenders. Take control of your future by planning ahead and securing the best terms for your student loan journey.