International students aspired for a standard of education at an American institution; however, the exorbitant fees of schooling and the requisite availability of housing and life placed the education out of reach for most of them. For many students, loans turn out to be the lifeline, but the impossibility of finding a cosigner with a good credit history in the United States makes any German applicant seem almost hopelessly doomed.

If you are among those finding it tough to swim through the murky waters of financing education without a cosigner, don’t be. This guide sums up the information international students need to relate to acquiring loans without a cosigner, from types of loans, qualifying requirements, and application tips to other funding options available.

Managing private student loans means you should understand your repayment options. While federal loans have flexible plans that are pretty easy for the borrower to recover, some might still wonder whether any IBR is available for private student loans. Unfortunately, IBR is not an option typically available with private lenders, although some may offer alternative repayment plans based on your income.

In case of unexpected financial difficulties, an emergency student loan might temporarily cover urgent expenses. Additionally, many students ask: Do private student loans go directly to the school? In most cases, private lenders disburse funds to the educational institution first, covering tuition and fees before distributing any remaining amount to the student.

Understanding the Need: Why International Students Seek Loans Without Cosigners

The Challenge of Cosigners

A cosigner’s role guarantees loan repayment, but finding someone who qualifies and is willing to take on that responsibility can be difficult. For international students, the challenge is magnified because:

- They may not have relatives or close friends in the U.S.

- U.S.-based cosigners are typically required to have strong credit histories and stable incomes.

Common Search Intent

Private loans that do not require a cosigner are actively being sought by international students. As more students around the world want to study in the U.S., demand for such financial products has grown.

The Dream of Studying in the USA

The USA houses many world-class universities and ample opportunities leading to rewarding careers. Yet with this dream come finance hurdles—annual tuition ranges between $20,000 and $60,000, besides living expenses.

Financial Obstacles

International students often face financial hurdles like:

- Limited savings or financial aid from home countries.

- Ineligibility for federal student loans.

- High upfront costs for visas, housing, and healthcare.

Graph: Estimated Annual Costs for International Students in the USA

| Expense Category | Low Range | High Range |

| Tuition | $20,000 | $60,000 |

| Housing | $8,000 | $15,000 |

| Living Expenses | $10,000 | $20,000 |

| Health Insurance | $1,200 | $2,500 |

| Total | $39,200 | $97,500 |

Types of International Student Loans Without Cosigner

Private Student Loans

Private lenders grant loans exclusively to foreign students who can readily apply without needing a cosigner. Such loans are usually based not on the applicant’s U.S. credit history but on his or her academic ability and potential to earn in the future. You can explore private student loans that don’t require a cosigner through lenders focusing on academic and professional potential rather than credit profiles.

Key Characteristics of No-Cosigner Loans:

- Loan Amounts: This may cover tuition, living costs, and other fees generally given.

- Interest Rates: Variable or fixed, usually at competitive or somewhat higher rates than most cosigner loans.

- Repayment: Loan terms run from 5 to 20 years, depending on specific lender terms.

Distinction Between Federal and Private Loans

Federal student loans are unavailable to international students, which makes private loans the go-to option. Unlike federal loans, private loans often require more rigorous eligibility criteria.

Loan Aggregators

Platforms like Prodigy Finance and MPOWER Financing act as aggregators, providing access to multiple lenders with competitive offers tailored to international students.

Comparison Table: Features of Popular No-Cosigner Loan Providers

| Lender | Loan Amount | Interest Rate | Repayment Term | Target Students |

| Prodigy Finance | $15,000-$50,000 | 9%-15% | 7-15 years | Postgraduate students |

| MPOWER Financing | $2,001-$50,000 | 7%-14% | 10 years | Undergraduate & graduate |

| Leap Finance | Customizable | 8%-16% | 5-10 years | Top university students |

| Juno | Varies | Competitive group rates | 10 years | All eligible students |

Detailed Eligibility Criteria for International Student Loans

Factors Lenders Consider

- Academic Performance: Strong grades and standardized test scores (e.g., TOEFL, GRE, GMAT) boost eligibility.

- Enrollment Status: Loans are often limited to students enrolled in accredited U.S. institutions.

- Repayment Capacity: Lenders assess earning potential post-graduation based on field of study and job market trends.

Required Documentation

To apply for a loan, you’ll typically need:

- Passport and visa information.

- University acceptance letter.

- Academic transcripts.

- Proof of funds or personal assets (if applicable).

- Any other lender-specific documents.

The Role of Credit History

While U.S. credit history is usually not required for no-cosigner loans, some lenders may assess credit reports from your home country or consider alternative data.

Specific Lenders Offering Loans to International Students

Although specific lender offerings require detailed research, the following are well-known providers:

- Prodigy Finance: Geared towards postgraduate students; requires no cosigner as the loan is based on the future potential income of the student.

- MPOWER Financing: For undergraduates and graduates alike. Fixed instruments for interest and repayment.

- Leap Finance: Best rates for most students from prestigious universities.

- Juno: Group negotiation increases the chances of better loan terms.

Alternative Funding Options for International Students

Scholarships and Grants

Many universities and private organizations offer scholarships based on merit, need, or field of study. Websites like Fastweb and InternationalScholarships.com are excellent resources.

Fellowships

Graduate students may qualify for fellowships that cover tuition and living expenses in exchange for research or teaching duties.

Funding from Home Country

Some governments or private organizations offer loans or scholarships to students studying abroad.

University Funding

Contact your university’s financial aid office for information on institution-specific funding opportunities.

Navigating the Loan Application Process

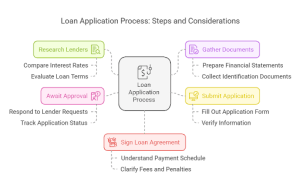

Step-by-Step Guide

- Research Lenders: Compare multiple lenders to find the best terms.

- Gather Documents: Ensure all required documents are complete and accurate.

- Submit Application: Complete the online application process, ensuring accuracy.

- Await Approval: Some lenders may require additional interviews or documents.

- Sign Loan Agreement: Review the terms carefully before signing.

Comparing Loan Offers

Evaluate offers based on the following:

- Interest rates (fixed vs. variable).

- Repayment flexibility.

- Additional fees or penalties.

What to Do If Rejected

- Explore alternative lenders.

- Apply for scholarships or grants.

- Consider part-time work opportunities allowed under your visa.

Pros and Cons of No-Cosigner Loans

Advantages

- Autonomy: No need to depend on a co-signer.

- Global Access: For students all over the world.

- Build Credit: Helps establish a credit profile in the U.S.

Disadvantages

- Higher Interest Rates: No-cosigner loans often come with steeper rates.

- Risk of Rejection: Stricter eligibility criteria can be a barrier.

- Repayment Challenges: Limited flexibility in repayment terms.

The Impact of Loan Terms on Total Cost

Interest Rates

Fixed rates provide predictable payments, while variable rates can fluctuate, potentially increasing costs.

Loan Duration

More extended repayment periods reduce monthly payments but increase overall interest costs.

Strategies to Minimize Costs

- Make interest-only payments during school.

- Refinance loans once you’ve established credit.

Pie Chart: Loan Costs Breakdown

(Include a pie chart showing the proportions of tuition, housing, interest, and fees for an average loan.)

Immigration and Visa Considerations

Visa Status

A loan does not directly affect visa eligibility, but maintaining financial stability is crucial for compliance.

Immigration Rules

Students must remain enrolled full-time to retain their visa status.

Staying Compliant

Ensure timely payments to avoid jeopardizing future visa renewals or applications.

Avoiding Scams and Predatory Lending

Warning Signs

- Upfront fees before loan approval.

- Vague terms or lack of transparency.

- Pressuring tactics.

Protecting Yourself

- Research lenders thoroughly.

- Use government or university-recommended resources.

- Check reviews and ratings.

Resources

Consult the Consumer Financial Protection Bureau (CFPB) and other regulatory bodies for guidance on legitimate lenders.

Conclusion

Getting an international student loan without a cosigner may feel overwhelming, but with the right research and preparation, it’s absolutely achievable. Don’t let financial barriers stop you from pursuing your dream education in the USA.

👉 Explore your options, compare trusted lenders, and uncover alternative funding sources today on Wealthopedia. Your journey toward a world-class education starts here—take charge of your future now!