Are you in need of a personal loan but unsure about where to start? Pre-approved personal loans could be your answer. These loans offer a clear view of your borrowing potential before you officially apply, saving you time and helping you make informed financial decisions.

In this guide, we’ll break down everything you need to know about pre-approved personal loans, their benefits, the application process, and how to choose the best offer for your financial situation. Whether you’re looking to consolidate debt, finance a big purchase, or cover unexpected expenses, understanding pre-approval can help you secure the best loan deal with confidence.

What Are Pre-Approved Personal Loans?

Pre-qualification vs. Pre-approval

Before diving into pre-approved loans, it’s important to understand the difference between pre-qualification and pre-approval.

Pre-qualification is a preliminary step where lenders provide an estimate of how much you may qualify for based on basic financial information. It usually involves a soft credit check, meaning it won’t impact your credit score. Pre-qualify personal loans allow borrowers to get an initial assessment without a hard inquiry on their credit report.

Pre-approval is a more detailed process. It involves a thorough review of your financial information and often includes a hard credit inquiry. A pre-approved loan offer gives you a stronger indication of how much you can borrow and under what terms. Seeking the best pre-approved personal loan ensures you get competitive rates and favorable terms.

If you’re unsure which loan option is right for you, comparing a personal loan vs. line of credit can help determine whether a lump sum loan or flexible credit access better suits your needs. Additionally, working with a personal loan broker can simplify the process by connecting you with multiple lenders and helping you find the best deal.

For borrowers who may not meet traditional bank requirements, a private lender loan can be an alternative solution, offering more flexible terms and potentially quicker approval processes. By understanding these loan options, you can make an informed decision tailored to your financial situation.

How Lenders Determine Pre-approval

Lenders assess your financial health by considering the following key factors:

1. Your Credit Score and History

Your credit score plays a significant role in determining preapproval because it gives lenders a way to understand how good of a borrower you have been based on what you have done in the past. A high credit score tells, on a broader level, whether a person exhibits responsible financial behavior and is at lower risk of defaulting on a loan, creating better chances for you to be pre-approved. Your credit, including payment history, length of credit history, and types of credit used, weighs into determining your eligibility.

2. Income and Employment Status

Lenders will want to confirm that you have a steady income adequate to repay the loan. Your income level and employment stability will lend insights into your financial capabilities. Consistent employment and a higher income take precedence in pre-approving a borrower party in a loan application. They may allow other sources of income, like rental income or dividends from investment, to contribute to the applicant’s suitability.

3. Debt-to-Income (DTI) Ratio

Your debt-to-income (DTI) ratio is the percentage of your monthly income that goes toward paying debts. Lenders calculate this ratio by dividing your total monthly debt payments by your gross monthly income. A lower DTI ratio (typically below 36%) demonstrates that you manage your debts responsibly and have sufficient income to handle additional loan payments.

4. Previous Loan Repayment History

Lenders look at your repayment history to see if you have a pattern of making the required payments on time for previously borrowed amounts and credit accounts. Late payments, defaults, and bankruptcies put you at a disadvantage for being pre-approved. Consistent on-time payments provide reassurance to lenders that you’re a responsible borrower.

Key Factors in Loan Preapproval

Factor Importance: How It Affects Preapproval

Credit Score & History High A higher score increases approval chances and lowers interest rates.

Income & Employment Status: High-stable employment and higher income improve eligibility.

Debt-to-Income Ratio: Medium to High. A lower ratio increases approval odds. Lenders prefer below 36%.

Loan Repayment History High A history of timely payments strengthens credibility.

Why Seek Preapproval?

The Benefits of Pre-Approved Personal Loans

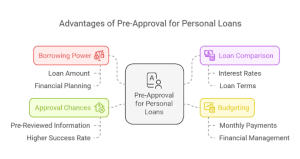

Getting pre-approved for a personal loan offers several advantages:

- Know Your Borrowing Power: Since a pre-approved loan presents the actual amount you may borrow, it gives you a brief idea of how much you’d need the money for.

- Compare Loan Offers: With preapproval, you can compare different lenders’ rates and terms before committing.

- Better Budgeting: Knowing the estimated interest rate and monthly payment helps you manage your finances.

- Higher Approval Chances: A preapproval increases your likelihood of securing a loan since the lender has already reviewed your information.

How Does the Preapproval Process Work?

Steps to Getting Pre-Approved

- Fill out a Prequalification Form. Provide basic details about your financial situation, including income, employment status, and outstanding debts.

- Undergo a Soft Credit Check – Lenders conduct a soft inquiry to assess your credit profile without affecting your score.

- Find Out If You Prequalify—Lenders to be approved for a loan based on your financial details. Based on your financial details

- Review Your Personal Loan Offers – If prequalified, you’ll receive multiple loan offers with different terms, interest rates, and repayment options.

- Formally Apply for a Loan – Choose the best offer and complete a formal application, which may involve a hard credit inquiry.

Best Companies Offering Pre-Approved Loans in the United States

Here are some of the best companies offering pre-approved personal loans in the U.S.:

- SoFi – Offers competitive rates, no origination fees, and a simple prequalification process. Visit SoFi.

- LightStream – A division of Truist Bank, known for low rates and fast approvals. Visit LightStream

- LendingClub – A peer-to-peer lender providing flexible loan options. Visit LendingClub.

- Upstart – Uses AI-driven approval, considering non-traditional credit factors. Visit Upstart.

- Discover Personal Loans – Offers competitive rates with no fees. Visit Discover

- Best Egg – Quick funding and flexible terms for various borrowers. Visit Best Egg.

- Upgrade – Provides financial tools and loans with fair terms. Visit Upgrade

- Marcus by Goldman Sachs – Offers no-fee loans with fixed interest rates. Visit Marcus.

- Avant – Specializes in personal loans for fair to good credit borrowers. Visit Avant.

- Prosper – A peer-to-peer lending platform offering competitive rates. Visit Prosper

Preapproval Process at a Glance

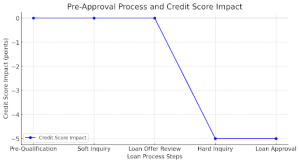

Step Action Credit Check Type Impact on Credit Score

1 Fill Out Prequalification Form None No Impact

2 Soft Credit Check Soft Inquiry No Impact

3 Receive Prequalification Results None No Impact

4 Review Loan Offers None No Impact

5 Formally Apply for Loan Hard Inquiry May Lower Score Slightly

Impact on Your Credit Score

Soft vs. Hard Inquiries

- Soft Inquiry: A soft credit check, used for prequalification, does not impact your credit score.

- Hard Inquiry: A hard credit check, used for preapproval, may slightly lower your credit score, but the impact is usually temporary.

To minimize adverse effects, avoid multiple hard inquiries in a short period.

Preapproval vs. Final Loan Approval

While preapproval is a strong indicator of eligibility, it does not guarantee final loan approval. Lenders may deny the final loan if:

- Your credit score drops due to new debt or missed payments.

- There are discrepancies in your provided information.

- Your financial situation changes significantly.

Choosing the Right Pre-Approved Loan Offer

Factors to Compare

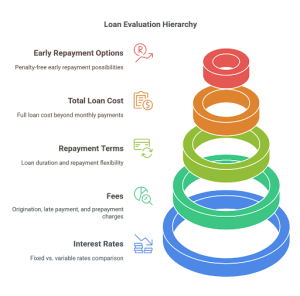

When evaluating pre-approved loan offers, consider:

- Interest Rates: Fixed vs. variable rates.

- Fees: Origination fees, late payment fees, and prepayment penalties.

- Repayment Terms: Loan duration and repayment flexibility.

- Total Loan Cost: Consider the full cost of the loan beyond just the monthly payment.

- Early Repayment Options: Some loans allow penalty-free early repayment, while others do not.

Pro Tip: Compare offers from multiple lenders to find the best deal.

Managing Your Credit During the Process

To maintain a strong credit profile while seeking preapproval:

- Avoid opening new credit accounts.

- Keep credit utilization low.

- Pay bills on time.

- Limit the number of hard inquiries.

What Happens After Preapproval?

Next Steps

After receiving a preapproval offer, you’ll need to:

- Submit a Formal Loan Application: Provide additional details and required documents.

- Await Final Approval: The lender must establish whether the information is correct and the credit risk is acceptable.

- Receive Funds: Upon final approval, funds are disbursed, typically within a few business days.

Typical Timeline

Depending on the lender, the time it takes to apply for preapproval can range from a few minutes to a few days.

Conclusion

Ready to take the next step toward smarter borrowing? Explore pre-approved personal loans on Wealthopedia and find the best offers tailored to your financial goals. Make confident, informed decisions and secure the financing you need—quickly and strategically.