Are Personal Loans a Viable Option for Startups?

According to the U.S. Small Business Administration (SBA), over 600,000 new businesses are launched yearly. However, securing funding remains one of the most prominent challenges entrepreneurs face. While traditional business and venture capital are familiar funding sources, many small business owners use personal loans as a financial lifeline. But is this the right choice for you?

This guide compares personal loans with more structured options like long-term business loans, offering a full perspective on the benefits and potential drawbacks for new entrepreneurs.

Understanding the Basics

What Is a Personal Loan?

A personal loan is a lump sum borrowed from a financial institution, typically repaid in fixed monthly installments. Unlike business loans, personal loans are based on the borrower’s creditworthiness rather than business revenue or operational history. This makes them attractive to new entrepreneurs who may not have a financial track record for their startups. In some cases, individuals may search for “company loan personal” options, looking for ways to use personal loans for business purposes.

| Loan Type | Collateral Required | Interest Rates | Approval Speed |

| Personal Loan | No | Higher | Faster |

| Business Loan | Yes | Lower | Slower |

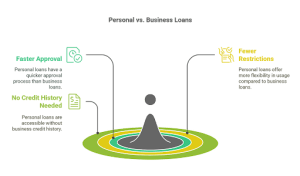

Why Consider a Personal Loan for Business?

Entrepreneurs often weigh the benefits of a personal loan vs. a line of credit, especially when they require flexibility in how and when to use the funds:

- Faster approval process – Personal loans often have a quicker timeline than business loans, which require extensive documentation.

- Fewer restrictions – Business loans typically require specific use cases, whereas personal loans offer more flexibility.

- No business credit history required – New businesses may struggle to obtain a business loan due to a lack of credit history, making personal loans an easier alternative.

Common Search Intent

Common Search Intent

Many individuals searching for personal loans for business, using a personal loan to start a business, long-term business loans, Micro business lending, or Private loans for business are likely exploring this financing option due to limited access to traditional business loans. This guide clarifies whether a personal loan is the right solution for your entrepreneurial journey.

When considering financing options, comparing a personal loan to a line of credit is essential to determine which best suits your needs. A personal loan provides a lump sum with fixed payments, while a line of credit offers flexible access to funds, allowing you to borrow as needed.

Working with a personal loan broker can simplify the loan search process by connecting borrowers with multiple lenders and securing competitive loan offers. Additionally, some lenders provide pre-approved personal loans, making it easier to access funds quickly based on your creditworthiness.

If traditional lenders aren’t an option, a private loan may offer more flexible terms for entrepreneurs who may not meet bank requirements. Understanding these options will help you make an informed financial decision for your business growth.

Best Broker Companies in the United States

If you are looking for help securing a loan, using a personal loan broker can simplify the process. Brokers connect you with various lenders, increasing your chances of approval and competitive interest rates:

- LendingTree – A leading online lending marketplace that connects borrowers with multiple lenders to find the best loan options. Visit LendingTree

- Credible – Offers comparison tools for personal and business loans, ensuring borrowers get competitive rates. Visit Credible

- Fiona – An AI-driven platform that matches borrowers with lenders based on their financial profile. Visit Fiona

- SoFi provides personal loans with low interest rates and no fees, tailored to entrepreneurs’ and businesses’ needs. Visit SoFi

- Prosper – A peer-to-peer lending platform offering personal loans with flexible repayment terms. Visit Prosper

- Upstart – Uses AI to assess loan eligibility beyond traditional credit scores, benefiting new business owners. Visit Upstart

- LightStream – A division of SunTrust Bank that offers low rates for personal loans for those with strong credit. Visit LightStream

These brokers can help streamline the loan search process and find the best financing solution for your business.

Types of Personal Loans and Their Suitability

Secured vs. Unsecured Loans

| Type of Loan | Collateral Required | Risk Level | Interest Rates |

| Secured | Yes | Lower | Lower |

| Unsecured | No | Higher | Higher |

Depending on your credit score and risk appetite, you might consider secured or unsecured personal loans. Unsecured loans are typically preferred by entrepreneurs who don’t want to risk personal assets.

If you’re not eligible for traditional lending options, a private lender loan might offer flexible alternatives, though often at higher interest rates.

Fixed vs. Variable Interest Rates

| Interest Type | Stability | Pros | Cons |

| Fixed | Stable | Predictable payments | May have higher initial rates |

| Variable | Fluctuates | Potentially lower rates | Payments can increase over time |

Risks and Benefits of Using Personal Loans for Business

Potential Risks

- Impact on personal credit score – Any missed payments can significantly damage your credit.

- Personal liability – Unlike business loans, personal loans make you responsible for repayment, even if the business fails.

- Higher interest rates – Personal loans typically carry higher interest rates than traditional business loans.

Potential Benefits

- Quick access to funds – Personal loans are usually approved faster than business loans.

- Easier qualification – Many business loans require a strong credit and revenue history, whereas personal loans rely solely on your credit score.

- Flexibility in use—Unlike some business loans, which must be used for specific purposes, personal loans can be used for various business expenses.

Some lenders provide pre-approved personal loans based on your credit score, which can be a faster route to financing but still requires careful consideration of repayment terms and financial risk.

Importance of a Balanced View

Before deciding on a personal loan, weigh the risks against the benefits to determine if this financing option aligns with your long-term business goals.

Alternatives to Personal Loans for Business

Not all funding has to come from borrowing. SBA loans, angel investors, crowdfunding, and business credit lines are viable alternatives.

If you’re unsure of which funding route to choose, comparing it to options like a personal loan to start a business can help you assess what aligns best with your business stage and goals.

Funding Options and Comparison

| Funding Option | Interest Rates | Approval Time | Repayment Terms |

| SBA Loans | Low | Slow | Longer repayment period |

| Business Credit Lines | Moderate | Moderate | Flexible |

| Angel Investors | No repayment | Slow | Equity loss |

| Crowdfunding | No repayment | Variable | No ownership loss |

| Bootstrapping | No interest | No approval required | Limited capital |

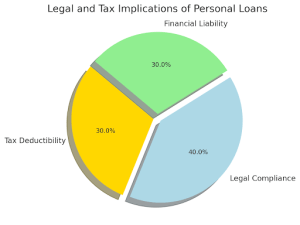

Legal and Tax Implications

Tax Treatment of Personal Loans

Personal loans are not tax-deductible unless the borrowed funds are used for business purposes. Proper documentation is necessary to justify tax deductions.

Legal Considerations

Mixing personal and business finances can lead to legal and tax complications. It’s crucial to maintain proper documentation to ensure that expenses and deductions are legitimate.

If you’re navigating complex terms like interest deductions or loan eligibility, understanding the structure of private loans for business can clarify your obligations and rights.

Seeking Professional Advice

Before taking out a personal loan, consult a tax or legal professional to ensure compliance with applicable laws.

Step-by-Step Guide to Applying for a Personal Loan

Step-by-Step Guide to Applying for a Personal Loan

- Preparation – Gather financial documents, including credit reports and income statements.

- Finding a Lender – Compare banks, credit unions, and online lenders.

- Completing the Application – Provide accurate financial information and state the intended use of the loan.

- Loan Approval Process – Understand approval timelines and potential lender requirements.

- Reviewing Loan Terms – Carefully read all conditions before signing.

- Managing the Loan – Make timely payments to maintain a strong credit score.

Working with a personal loan broker at this stage can improve your chances of success by connecting you to multiple suitable offers from trusted lenders.

Financial Planning and Budgeting

- A solid business plan, realistic revenue forecasts, and a clear repayment strategy are essential for avoiding financial strain.

- If you’re building your startup lean, it may be helpful to explore personal loans designed for business use, which often come with fewer restrictions than traditional business loans.

Conclusion

Using a personal loan to start a business can be a smart funding move when traditional options fall short, but your success depends on careful planning, disciplined budgeting, and a clear understanding of the risks involved.

Ready to take the next step? Visit Wealthopedia to explore expert insights, compare loan options, and connect with trusted brokers who can help you find the best personal loan solution for your startup journey.