You’ve just brought home your adorable bundle of fur, and between the potty training and puppy-proofing, you’re probably wondering: Is pet insurance worth it for a puppy? As a new pet parent, this decision might feel overwhelming—especially when you’re already spending on toys, food, and those ever-growing vet bills.

I get it. Three months ago, I was in your shoes, staring at my Golden Retriever puppy, Max, while simultaneously scrolling through dozens of pet insurance options. The deductibles, the waiting periods, the fine print… it can make your head spin faster than your puppy chases their tail.

But here’s the truth: making the right choice about pet insurance now could save you thousands down the road—and more importantly, it could give you peace of mind during those inevitable puppy emergencies.

What Is Pet Insurance and How Does It Actually Work?

Pet insurance operates similarly to human health insurance but with some key differences. Unlike human insurance, most pet insurance works on a reimbursement model:

- You pay the vet bill upfront

- Submit a claim to your insurance company

- Receive reimbursement based on your policy terms

Most pet insurance plans include three main components:

- Premium: Your monthly payment (typically $30-$70 for puppies)

- Deductible: The amount you pay before insurance kicks in (usually $100-$1,000 annually)

- Reimbursement percentage: How much of the bill your insurer covers after the deductible (typically 70-90%)

For example, if your puppy needs a $1,000 emergency procedure, you have a $250 deductible, and an 80% reimbursement rate, you’d pay $250 plus 20% of the remaining $750 ($150), for a total of $400. Insurance would cover the remaining $600.

How Much Does Pet Insurance Cost for a Puppy in the U.S.?

The cost of pet insurance varies widely depending on several factors:

| Factor | How It Affects Pricing |

| Breed | Breeds prone to health issues cost more to insure |

| Location | Higher vet costs in your area = higher premiums |

| Age | Younger puppies typically cost less to insure |

| Coverage level | More comprehensive coverage = higher premiums |

| Deductible | Higher deductible = lower monthly premium |

For a 3-month-old Golden Retriever like Max in Austin, TX, I found premiums ranging from $35 to $70 per month for comprehensive coverage. At the same time, this might seem like another expense to add to your growing puppy budget, but getting insurance early can save you significantly in the long run.

The Perfect Time: When Should You Get Pet Insurance for Your Puppy?

The short answer: as soon as possible after adoption.

Here’s why timing matters:

- No pre-existing conditions: Insurance doesn’t cover conditions that develop before enrollment

- Lower premiums: Rates are typically lower for younger, healthier pets

- Puppies are accident-prone: Those first few months are prime time for swallowing socks or tumbling downstairs

According to the American Veterinary Medical Association, puppies should visit the vet several times during their first year for vaccinations and checkups. Getting insurance before these visits can help offset these predictable costs if you opt for a plan with wellness coverage.

What’s Covered (and What’s Not) in Puppy Insurance Plans

Typically Covered:

- Accidents (including injuries, foreign object ingestion)

- Illnesses (including infections, allergies, digestive issues)

- Diagnostic tests (blood work, x-rays, etc.)

- Surgeries and hospitalizations

- Hereditary and congenital conditions (if enrolled early)

- Prescription medications

Usually Not Covered:

- Pre-existing conditions

- Routine care (unless you add a wellness plan)

- Cosmetic procedures

- Breeding costs

- Experimental treatments

It’s worth noting that some providers offer wellness add-ons that cover preventive care like vaccinations, spay/neuter procedures, and annual checkups. These typically cost an additional $10-$25 per month.

Are Routine Vet Visits and Vaccinations Covered?

Standard pet insurance plans typically do not cover routine care. However, many providers offer optional wellness plans that can be added to your policy.

A wellness plan might cover the following

- Annual exams

- Vaccinations

- Flea and tick prevention

- Heartworm testing and prevention

- Dental cleanings

- Spay/neuter procedures

For a puppy in their first year, these services can add up to $500-$1,000, so a wellness plan (typically $10-$25 monthly) might be worth considering, especially during that crucial first year.

The Honest Truth: Pros and Cons of Pet Insurance for Puppies

Pros:

- Financial protection against unexpected emergencies

- Peace of mind knowing you won’t have to choose between your puppy’s health and your savings

- Freedom to choose treatment options without cost is the primary factor

- Lower lifetime costs when enrolled early before pre-existing conditions develop

- Predictable monthly expense versus unpredictable emergency costs

Cons:

- Monthly premiums, regardless of whether you file claims

- Out-of-pocket costs still exist (deductibles and co-pays)

- Certain exclusions may apply depending on the policy

- Reimbursement model means paying upfront before getting money back

- Potential premium increases as your puppy ages

Is Pet Insurance Worth It If My Puppy Is Healthy?

This is perhaps the most common question I hear from fellow puppy parents at the dog park. The answer depends on your risk tolerance and financial situation, but consider this:

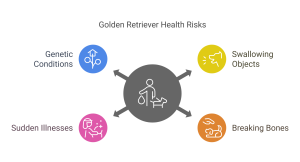

According to PreventiveVetst, the average cost of an emergency vet visit ranges from $800 to $1,500, and complex emergencies can cost $3,000-$5,000 or more. Even healthy puppies can:

- Swallow objects they shouldn’t

- Break bones during play

- Develop sudden illnesses

- Have genetic conditions that don’t show symptoms until later

Golden Retrievers like Max are prone to hip dysplasia and certain cancers, which can cost thousands to treat. Even if your puppy is healthy now, insurance is about protecting against future unknowns.

Think of it this way: pet insurance isn’t about paying for what you know will happen—it’s about preparing for what you hope won’t happen.

What to Look for in a Pet Insurance Policy for Your Puppy

When comparing policies, consider these key factors:

- Waiting periods: How long before coverage begins (typically 14 days for illnesses, 48 hours for accidents)

- Annual limits: Maximum amount reimbursed per year ($5,000, $10,000, or unlimited)

- Reimbursement percentage: How much of eligible expenses are covered (70%, 80%, or 90%)

- Deductible options: Higher deductibles mean lower monthly premiums

- Coverage exclusions: Specific conditions or treatments not covered

- Premium increases: How rates may change as your puppy ages

- Claim process: How easy it is to file claims and get reimbursed

Pro tip: Look for policies that cover hereditary conditions specific to your puppy’s breed. For Golden Retrievers, coverage for hip dysplasia and cancer treatments is particularly important.

The Top Pet Insurance Companies for Puppies in the U.S.

After hours of research and comparing dozens of quotes for Max, here are some top-rated providers worth considering:

- Healthy Paws: Known for unlimited annual benefits and straightforward policies

- Embrace: Offers diminishing deductibles for years without claims

- Lemonade: User-friendly app and quick claim processing

- Nationwide: One of the few providers covering avian and exotic pets

- Trupanion: Pays vet directly in some cases, eliminating upfront costs

Each provider has its strengths, so request quotes from multiple companies before making your decision. Most offer free quotes online in minutes.

Can I Switch Pet Insurance Providers Later?

Yes, you can switch providers, but there’s a significant catch: any condition diagnosed or treated under your previous policy will be considered pre-existing by your new provider.

For example, if your puppy develops allergies while insured with Company A, those allergies won’t be covered if you switch to Company B later. This is why choosing the right provider from the start is so important.

If you’re unhappy with your current provider, consider:

- Checking if they can adjust your current policy

- Weighing the cost of switching against the benefits

- Switching only if your puppy is relatively healthy with no chronic conditions

Making the Decision: Is Pet Insurance Right for Your Puppy?

After all this information, you might still be wondering if pet insurance is worth it for your specific situation. Consider these factors:

- Your financial situation: Could you handle a surprise $3,000-$5,000 vet bill?

- Your puppy’s breed: Some breeds have higher risks of expensive health issues

- Your risk tolerance: How comfortable are you with uncertainty?

- Your puppy’s lifestyle: Active dogs or those with access to potential hazards may be at higher risk

For me and Max, the decision came down to peace of mind. While the monthly premium adds up over time, knowing I’ll never have to choose between my bank account and his health is worth every penny.

Final Thoughts: Beyond the Policy

Remember that pet insurance is just one part of responsible pet ownership. Preventive care like regular exercise, proper nutrition, and timely vaccinations can help keep your puppy healthy and reduce the likelihood of claims.

Whether you choose to insure your puppy or not, consider setting aside an emergency fund specifically for vet care. This can supplement your insurance or serve as a self-insurance policy if you decide to forego traditional coverage.

Have you made a decision about pet insurance for your puppy? I’d love to hear about your experience in the comments below! If you find this guide helpful, please share it with other puppy parents who might be wrestling with the same decision.

Disclaimer: This blog post is for informational purposes only and does not constitute financial or veterinary advice. Always consult with a licensed veterinarian and financial advisor before making decisions about your pet’s healthcare.