Auto insurance is a crucial financial safeguard, protecting drivers from unforeseen accidents and liabilities. Yet, many policyholders are surprised to discover just how much insurance rates vary from state to state. Understanding these differences can help drivers make informed decisions and potentially lower their premiums.

This guide delves into why car insurance costs differ by state, the factors that influence pricing, and actionable strategies to find the best rates. Whether you’re moving to a new state, shopping for a new policy, or simply curious about the trends shaping insurance costs, this article provides valuable insights tailored to U.S. drivers looking for cheap auto insurance in Indiana, cheapest car insurance in Maryland, and car insurance in South Carolina.

Why Do Car Insurance Costs Vary by State?

One of the primary reasons insurance rates fluctuate so much between states is the varying regulations governing the industry. Each state has its own set of requirements, minimum coverage levels, and consumer protection laws, all of which impact insurance pricing.

The Role of State Regulations

Some states enforce strict liability insurance requirements, while others have more lenient laws. For example, states with “no-fault” insurance laws often have higher premiums because insurance providers are required to cover medical expenses regardless of who is at fault in an accident. Conversely, states with lower minimum coverage requirements tend to have more affordable insurance rates.

Population Density and Driving Environments

Urban areas with heavy traffic, such as New York or California, tend to have higher insurance rates due to increased accident risks. In contrast, rural states like North Dakota or Wyoming, where fewer cars are on the road, typically see lower premiums. The congestion and exposure to potential accidents in city driving make a significant impact on insurance costs.

Accident Rates and Uninsured Drivers

A state’s overall accident rate plays a crucial role in determining insurance premiums. States with a high number of accidents and claims, like Louisiana or Florida, often experience increased insurance costs. Additionally, the number of uninsured drivers in a state affects pricing, as insurance companies must account for potential unpaid claims.

Weather and Crime Rates

Severe weather events, such as hurricanes in Florida or snowstorms in Michigan, can lead to higher claims, driving up costs. Additionally, high crime rates, particularly vehicle theft, can push insurance premiums higher in states with elevated crime statistics.

Average Auto Insurance Rates by State

Insurance rates vary widely across the U.S., influenced by the factors mentioned above. While exact premiums change frequently, drivers can expect a broad range depending on their location. It’s important to understand that the goal is not to pinpoint exact numbers but to highlight the dramatic differences that exist from state to state.

For example, states like Michigan and Florida consistently rank among the most expensive for auto insurance, while states like Vermont and North Carolina tend to have some of the lowest premiums.

| State | Full Coverage Rates | Liability-Only Rates | State-Minimum Rates |

|---|---|---|---|

| Alabama | $1,860 | $639 | $433 |

| Alaska | $1,676 | $508 | $398 |

| Arizona | $1,812 | $764 | $516 |

| Arkansas | $1,957 | $589 | $397 |

| California | $2,416 | $864 | $551 |

| Colorado | $2,337 | $717 | $437 |

| Connecticut | $1,725 | $783 | $704 |

| Delaware | $2,063 | $1,022 | $788 |

| Florida | $2,694 | $1,629 | $993 |

| Georgia | $1,970 | $789 | $577 |

| Hawaii | $1,517 | $572 | $396 |

| Idaho | $1,428 | $440 | $357 |

| Illinois | $1,532 | $471 | $421 |

| Indiana | $1,515 | $498 | $417 |

| Iowa | $1,630 | $320 | $260 |

| Kansas | $1,900 | $471 | $434 |

| Kentucky | $2,228 | $810 | $606 |

| Louisiana | $2,883 | $1,266 | $722 |

| Maine | $1,175 | $341 | $335 |

| Maryland | $1,746 | $756 | $727 |

| Massachusetts | $1,726 | $655 | $511 |

| Michigan | $2,266 | $645 | $604 |

| Minnesota | $1,911 | $512 | $475 |

| Mississippi | $2,008 | $637 | $463 |

| Missouri | $1,982 | $582 | $488 |

| Montana | $2,193 | $540 | $350 |

| Nebraska | $1,902 | $373 | $331 |

| Nevada | $2,060 | $1,042 | $720 |

| New Hampshire | $1,265 | $416 | $397 |

| New Jersey | $1,902 | $915 | $853 |

| New Mexico | $2,049 | $658 | $421 |

| New York | $1,870 | $827 | $731 |

| North Carolina | $1,741 | $523 | $476 |

| North Dakota | $1,665 | $370 | $349 |

| Ohio | $1,417 | $446 | $362 |

| Oklahoma | $2,138 | $657 | $408 |

| Oregon | $1,678 | $710 | $641 |

| Pennsylvania | $1,872 | $504 | $375 |

| Rhode Island | $2,061 | $808 | $646 |

| South Carolina | $2,009 | $925 | $720 |

| South Dakota | $2,280 | $338 | $307 |

| Tennessee | $1,677 | $547 | $442 |

| Texas | $2,043 | $774 | $572 |

| Utah | $1,825 | $756 | $582 |

| Vermont | $1,319 | $324 | $306 |

| Virginia | $1,469 | $477 | $428 |

| Washington | $1,608 | $731 | $438 |

| Washington, D.C. | $2,157 | $785 | $558 |

| West Virginia | $2,005 | $585 | $510 |

| Wisconsin | $1,664 | $425 | $365 |

| Wyoming | $1,758 | $331 | $288 |

This table provides a clear comparison of full coverage, liability-only, and state-minimum rates across the United States. If you’re looking for cheapest car insurance in Maryland or cheap auto insurance in Indiana, it’s worth comparing state regulations and insurer offerings to find the best deal.

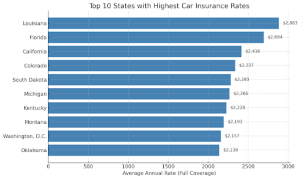

The Most Expensive States for Auto Insurance

Some states have significantly higher insurance rates due to a combination of factors. Michigan, for instance, has historically led the nation in high premiums due to its unique no-fault insurance laws. Florida follows closely, with high accident rates, frequent severe weather, and a large number of uninsured drivers contributing to expensive policies. Louisiana and New York also rank high, thanks to dense urban populations and extensive insurance requirements.

These states highlight how local factors, such as regulation, accident statistics, and climate, directly impact the cost of auto insurance.

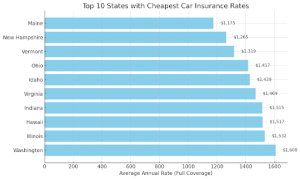

The Cheapest States for Auto Insurance

On the other end of the spectrum, states like Vermont, North Carolina, and Maine enjoy some of the lowest insurance costs. These states benefit from low population density, fewer accidents, and favorable insurance regulations that keep rates in check. For example, North Carolina has a unique rate bureau system that helps standardize pricing, keeping premiums affordable for residents.

How Have Auto Insurance Rates Changed Over the Past Two Years?

Auto insurance rates are dynamic and change due to several external factors. Over the past two years, premiums have generally increased, largely due to rising accident rates, inflation, and advanced vehicle technology driving up repair costs.

Additionally, severe weather patterns, such as hurricanes and wildfires, have contributed to more claims, leading insurers to adjust pricing. Changes in state laws and the growing prevalence of distracted driving have also influenced the upward trend in insurance costs across many regions.

Year-Over-Year Insurance Rate Changes

Average Auto Insurance Rates by State (2022-2025)

| State | 2022 Average Rates | 2023 Average Rates | 2024 Average Rates | 2025 Average Rates |

|---|---|---|---|---|

| Alabama | 1451 | 1860 | 2166.9 | 2329.4175 |

| Alaska | 1354 | 1676 | 1952.54 | 2098.9805 |

| Arizona | 1480 | 1812 | 2110.98 | 2269.3035 |

| Arkansas | 1423 | 1957 | 2279.905 | 2450.8979 |

| California | 2110 | 2416 | 2814.64 | 3025.738 |

| Colorado | 1807 | 2337 | 2722.605 | 2926.8004 |

| Connecticut | 1736 | 1725 | 2009.625 | 2160.3469 |

| Delaware | 2135 | 2063 | 2403.395 | 2583.6496 |

| Florida | 2583 | 2694 | 3138.51 | 3373.8983 |

| Georgia | 1570 | 1970 | 2295.05 | 2467.1788 |

| Hawaii | 1306 | 1517 | 1767.305 | 1899.8529 |

| Idaho | 1045 | 1428 | 1663.62 | 1788.3915 |

| Illinois | 1378 | 1532 | 1784.78 | 1918.6385 |

| Indiana | 1184 | 1515 | 1764.975 | 1897.3481 |

| Iowa | 1319 | 1630 | 1898.95 | 2041.3713 |

| Kansas | 1529 | 1900 | 2213.5 | 2379.5125 |

| Kentucky | 1869 | 2228 | 2595.62 | 2790.2915 |

| Louisiana | 2535 | 2883 | 3358.695 | 3610.5971 |

| Maine | 1100 | 1175 | 1368.875 | 1471.5406 |

| Maryland | 1486 | 1746 | 2034.09 | 2186.6468 |

| Massachusetts | 1528 | 1726 | 2010.79 | 2161.5992 |

| Michigan | 2158 | 2266 | 2639.89 | 2837.8817 |

| Minnesota | 1463 | 1911 | 2226.315 | 2393.2886 |

| Mississippi | 1494 | 2008 | 2339.32 | 2514.769 |

| Missouri | 1948 | 1982 | 2309.03 | 2482.2073 |

| Montana | 1751 | 2193 | 2554.845 | 2746.4584 |

| Nebraska | 1955 | 1902 | 2215.83 | 2382.0173 |

| Nevada | 1978 | 2060 | 2399.9 | 2579.8925 |

| New Hampshire | 1268 | 1265 | 1473.725 | 1584.2544 |

| New Jersey | 1928 | 1902 | 2215.83 | 2382.0173 |

| New Mexico | 1516 | 2049 | 2387.085 | 2566.1164 |

| New York | 2072 | 1870 | 2178.55 | 2341.9413 |

| North Carolina | 1324 | 1741 | 2028.265 | 2180.3849 |

| North Dakota | 1285 | 1665 | 1939.725 | 2085.2044 |

| Ohio | 998 | 1417 | 1650.805 | 1774.6154 |

| Oklahoma | 1700 | 2138 | 2490.77 | 2677.5778 |

| Oregon | 1249 | 1678 | 1954.87 | 2101.4853 |

| Pennsylvania | 1256 | 1872 | 2180.88 | 2344.446 |

| Rhode Island | 1717 | 2061 | 2401.065 | 2581.1449 |

| South Carolina | 1902 | 2009 | 2340.485 | 2516.0214 |

| South Dakota | 1553 | 2280 | 2656.2 | 2855.415 |

| Tennessee | 1313 | 1677 | 1953.705 | 2100.2329 |

| Texas | 1796 | 2043 | 2380.095 | 2558.6021 |

| Utah | 1428 | 1825 | 2126.125 | 2285.5844 |

| Vermont | 1081 | 1319 | 1536.635 | 1651.8826 |

| Virginia | 1224 | 1469 | 1711.385 | 1839.7389 |

| Washington | 1213 | 1608 | 1873.32 | 2013.819 |

| Washington, D.C. | 1845 | 2157 | 2512.905 | 2701.3729 |

| West Virginia | 1536 | 2005 | 2335.825 | 2511.0119 |

| Wisconsin | 1311 | 1664 | 1938.56 | 2083.952 |

| Wyoming | 1617 | 1758 | 2048.07 | 2201.6753 |

Factors Impacting Auto Insurance Rates (Beyond State Lines)

While state and regional factors are significant in determining auto insurance rates, individual circumstances and choices can heavily influence the cost of coverage. Here are some personal and policy-related factors that play a role:

Demographic Considerations

- Age: Younger drivers often face higher premiums due to their inexperience, while older drivers may see increased rates as accident risks rise. For example, teens in states like South Carolina often pay much higher rates, making it critical to compare quotes for affordability.

- Driving Record: A clean driving record can significantly lower premiums, while a history of accidents or violations increases costs. Maintaining a good record is essential for securing cheap auto insurance in Indiana or other competitive states.

- Credit Score: Many insurers assess credit scores to gauge risk. A poor credit score can lead to higher premiums, especially in states like Maryland where insurance pricing incorporates this factor.

- Gender: Some states permit insurers to use gender as a factor in pricing. While this is becoming less common, drivers in certain areas might notice small rate differences between male and female drivers.

Coverage Types and Their Impact

Selecting the right type of insurance coverage is crucial for managing costs while ensuring adequate protection:

- Liability Insurance: Covers damages to others in an accident you cause. This is the minimum required in most states, including Texas, where liability-only policies are common.

- Collision Coverage: Pays for damages to your own car after an accident. This is more relevant for newer vehicles and drivers in regions prone to heavy traffic, such as California.

- Comprehensive Coverage: Protects against non-collision events, such as theft, vandalism, or natural disasters. For residents in states like South Carolina, where hurricanes are frequent, this coverage can be vital.

Choosing the right coverage depends on factors like the vehicle’s value, the driver’s financial situation, and local risks. For those with older cars, opting for liability insurance might suffice to reduce costs.

Comparing Insurance Companies

Not all insurance providers are created equal. Finding the best rate often requires shopping around and comparing quotes. Here are some key factors to consider:

- Customer Service: High-quality customer support can make a significant difference during claims processing. Exploring the best auto insurance companies in your region ensures a smoother experience.

- Discounts: Many providers offer discounts for bundling policies, having a clean driving record, or installing safety devices in your car. These discounts can help lower costs in states with high premiums, like California.

- Claims Handling: The efficiency of claims processing varies widely. Opting for insurers with strong reputations in this area can save time and stress during an emergency.

If you live in Texas, for example, comparing providers can help you find competitive car insurance in Texas that meets your needs while offering excellent customer service.

Tips for Lowering Auto Insurance Costs

Regardless of your state, there are proven strategies for reducing premiums:

- Maintain a Clean Driving Record: Avoiding traffic violations and accidents qualifies you for safe-driver discounts, especially in states like Maryland.

- Improve Your Credit Score: A better credit score can lead to lower premiums in many states.

- Bundle Policies: Combining auto insurance with home or renters insurance often results in discounts.

- Raise Deductibles: Opting for higher deductibles reduces monthly premiums but increases out-of-pocket expenses during claims.

- Assess Coverage Needs: For older vehicles, liability insurance may suffice, helping reduce overall costs.

The Future of Auto Insurance

As technology and consumer behavior evolve, so does the landscape of auto insurance. Several trends are shaping the industry:

- Self-Driving Cars: The rise of autonomous vehicles may reduce accident rates over time, potentially lowering premiums. States like California are already seeing increased adoption of this technology.

- Usage-Based Insurance: Programs that adjust premiums based on driving habits are gaining popularity. These can be especially beneficial for low-mileage drivers in states like Indiana.

- Regulatory Changes: Future updates to state laws may impact how rates are calculated, influencing premiums nationwide.

Frequently Asked Questions

Here are answers to some common questions about auto insurance costs:

- Why is auto insurance so expensive in my state? Rates depend on regulations, accident statistics, and local risk factors. In states with urban centers like California, traffic density and theft rates significantly impact costs.

- How can I find the best rate? Shopping around, improving your credit, and maintaining a clean driving record can help. For cheap auto insurance in Indiana or cheapest car insurance in Maryland, compare quotes frequently.

- Is full coverage necessary? It depends on your vehicle’s value and your personal risk tolerance. For older vehicles in Texas, liability-only policies might be sufficient.

Conclusion

Auto insurance rates are influenced by various factors, from state laws to personal driving habits. Understanding these elements allows drivers to make informed decisions and find the best possible coverage at an affordable price. If you’re looking to optimize your auto insurance costs, take the time to compare quotes, assess your coverage needs, and explore available discounts.

Ready to start saving? Get personalized insurance quotes today and take control of your car insurance expenses.