Just imagine wading through all those confusing auto insurance options so you can get decent coverage at an affordable price. And yet, perhaps more than just another legal requirement, auto insurance protects you and your assets.

This guide is designed for middle-class Americans over 25 who live in the USA. It seeks to help you sift through the complicated processes of getting the best auto insurance companies that will meet your needs and fit your budget. We’ll talk about some of the best-rated companies, car evaluation on a 3-point scale, coverage options, and money-saving ideas.

Understanding Your Auto Insurance Needs

Why Do You Need Auto Insurance?

Auto insurance protects you from accidents, thefts, and unforeseen events. It is a legal requirement in most states to protect drivers from liability and their own assets.

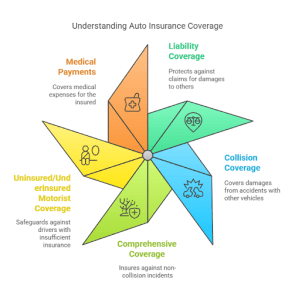

Types of Coverage Explained

- Liability Coverage – Liability insurance covers bodily injury and property damage to others in accidents wherein you were at fault.

- Collision Coverage – If your vehicle sustains damages from a collision, this will cover the expenses regardless of fault.

- Comprehensive Coverage – Protects against events other than a collision (such as theft, vandalism, or damage caused by the weather).

- Uninsured/Underinsured Motorist Coverage – This contingency comes to your aid for damages in case the at-fault driver possesses no insurance or has very little insurance.

- Medical Payments (MedPay) – Helps clear any medical expenses for you or your passengers post-accident.

Optimizing Your Coverage Needs

Optimizing Your Coverage Needs

Analyze your financial health, vehicle worth, and driving habits, including vehicle age and kind, geographic location, daily usage, and commute distance.

Principles on Evaluating Companies for an Automobile Insurance Selection Guide

Customer Solace

Good reviews and high customer satisfaction rates supposedly indicate reliable service.

Claims Processing

The method of settlement will influence the actual insurance figure. Seek out companies that do what they are known to do best—settle claims expeditiously and fairly.

Range of Coverage

The best companies offer a variety of coverages, sometimes even specialized coverages.

Financial Security

An AM Best or Moody’s rating will tell you whether the company will be able to meet its claims.

Ethics

Monitor that while evaluating how much social responsibility and community support these insurance businesses demonstrate.

Top Auto Insurance Companies in the USA

Overview of Top-Rated Companies

State Farm

- History: Founded in 1922

- Reputation: Affordability with a good network of agents

- Strengths: Broad policies with essential services

GEICO

- History: Established in 1936

- Reputation: For online convenience and competitive rates

- Strengths: Broad variety of discounts

Progressive

- History: Founded in 1937

- Reputation: First insurer to modernize with Snapshot

- Strengths: Flexible pricing and diversity of coverage

Allstate

- History: Established in 1931

- Reputation: Strong personalized services with bundling discounts

- Strengths: Great customer service network

Comparative Analysis

| Company | Customer Satisfaction | Claims Handling | Coverage Options | Discounts Available |

| State Farm | Excellent | Quick | Comprehensive | Multi-policy, Safe Driver |

| GEICO | Very Good | Efficient | Wide Range | Good Student, Military |

| Progressive | Good | Flexible | Extensive | Usage-based, Bundling |

| Allstate | Excellent | Thorough | Broad | Loyalty, Multi-policy |

AARP auto insurance reviews and Amica insurance reviews highlight customer satisfaction and coverage reliability as critical factors in making informed decisions.

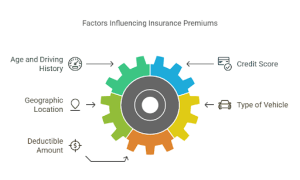

Understanding Factors Affecting Your Premiums

Key Influences on Premium Costs

- Age and Driving History – Usually, a younger driver will have a higher cost because of his or her inexperience. The cleaner your driving record, the cheaper your costs.

- Credit Score – The high credit score indicates reliability, and reasonable insurance premiums would thus follow.

- Geographic Location – Premiums will be highest in cities with maximum traffic risks.

- Type of Vehicle – Luxury or high-risk cars usually cost more to insure.

- Deductible Amount – Higher deductibles drive the premiums lower, thus increasing the rates at which one operates out of pocket.

How to Lower Your Auto Insurance Premiums

How to Lower Your Auto Insurance Premiums

Practical Money-Saving Tips

Discounts

- Multi-policy

- Safe driver

- Good student

- Military

Other Ways to Save

- Increase Your Deductible – Opt for a higher deductible to lower monthly premiums.

- Improve Your Credit Score – Pay bills on time and reduce debt to boost your score.

- Shop Around – Compare quotes from multiple insurers for the best deal.

- Maintain a Clean Driving Record – Avoid traffic violations and accidents to ensure lower rates.

- Bundling Auto and Renters Insurance – Can result in significant savings.

The Process of Claims: What Is Primed Up?

Initiating a Claim

- Once something happens, tell your insurer as soon as possible.

- Attach proof of the event: some pictures and a police report.

How the Process Goes

- The insurer will investigate, assess damages, and make a payout.

- Consider yourself informed during the investigation.

What to Do About Claim Denials

- If denied, you may want to request an explanation and ask for an appeal with additional proof.

- Auto insurance claims ratings provide valuable insights into how companies handle claims efficiently and fairly.

Emerging Trends in Auto Insurance

Telematics and Usage-Based Insurance

- Programs such as DriveEasy by GEICO are equipped with tracking technologies that reward good driving behavior.

Impact of Electric Vehicles

- EV insurance policies must address unique repair issues and battery costs.

Autonomous Driving Technology

- As automakers will be at fault for accidents, these policies must evolve.

Insurance Agents Versus Direct Purchase

Local Agents

- Personalized service.

- Advisor support in picking the right policy.

Purchasing Online

- Comfortable.

- Provides the ability to compare rates.

Conclusion

Finding the best auto insurance company requires a clear understanding of your needs, budget, and preference for coverage. From the ratings of providers, you can compare various policies and discounts to ensure maximum coverage at a reasonable price for your car and financial returns.

First, understand your coverage needs and compare quotes from different companies for one that gives you the most for the lowest price. With some work, you’ll find the ideal auto insurance policy to protect your future.