Finding yourself with debt in collections can be stressful, but the good news is that resolving it is easier than ever with online options. This guide will walk you through the process of paying off collection debt online, helping you take control of your finances and improve your credit score.

The Digital Path to Debt Resolution

Let’s face it—opening those collection notices or receiving those persistent phone calls can make your stomach drop. If you’re like many Americans juggling work, family, and financial responsibilities, dealing with debt collectors might feel overwhelming. But here’s the silver lining: technology has made it significantly easier to address collection debt on your own terms, from the privacy of your home, and often with better results than traditional payment methods.

As a busy professional trying to regain financial stability, you’ve already taken the most important step by researching your options. Now, let’s walk through exactly how to handle collection debt online effectively and securely.

Verify the Debt Before Making Any Payments

Before you click that “pay now” button, it’s crucial to verify that the debt is legitimate and that you’re paying the right party.

Steps to verify your debt:

- Request written validation – Under the Fair Debt Collection Practices Act, you have the right to request written verification of any debt.

- Check your credit reports – Visit AnnualCreditReport.com to verify the collection account.

- Confirm the collection agency’s legitimacy – Search their name on the CFPB’s consumer complaint database.

- Watch for red flags – Avoid collectors who pressure or request unusual payment methods.

Online Payment Options for Collection Debt

Once you’ve verified the debt, you have several online payment options:

| Payment Method | Pros | Cons |

| Debt Collector’s Website | Direct connection,often includes payment confirmation | May have processing fees |

| Bank Transfer/ACH | Typically free, good paper trail | Takes 1-3 business days to process |

| Credit/Debit Card | Immediate processing, reward points possible | Usually incurs convenience fees (2-3%) |

| Payment Apps (PayPal, Venmo) | Convenient, familiar interface | May have limitations on transaction amounts |

| Online Check Services | Good for scheduled payments | Processing time varies |

Pro tip:

Pro tip: Always choose a method that provides confirmation. Learn how to track your progress using a credit card payment tracker.

Negotiating a Settlement Online

Before paying the full amount, consider negotiating a settlement. Many collection agencies offer online negotiation tools that let you propose a reduced payment amount.

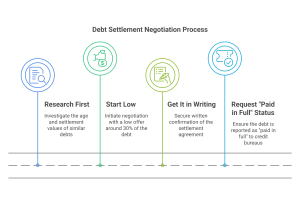

How to negotiate effectively online:

- Research first – Before making an offer, check how old the debt is and how much similar debts settle for (often 40-60% of the original amount).

- Start low – Begin with an offer around 30% of the debt value. The collector will likely counteroffer.

- Get it in writing – Never pay until you have written confirmation of the settlement agreement. Most agencies can provide this via email or their online portal.

- Request “paid in full” status – When settling, explicitly request that the account be reported to credit bureaus as “paid in full” rather than “settled.”

Setting Up Payment Plans Online

If you can’t pay the full amount at once, many collection agencies offer online payment plan options:

- Log into the agency’s portal – Create an account on the collection agency’s website if you haven’t already.

- Review available plans – Most agencies offer 3-12 month payment plans, with some extending up to 24 months for larger debts.

- Configure automated payments – Setting up automatic payments often comes with additional benefits like waived convenience fees.

- Track your progress – Good online portals show your payment history and remaining balance.

Warning: Be cautious if your payment plan risks extending past the statute of limitations.

Security Considerations for Online Debt Payments

When dealing with sensitive financial information online, security is paramount:

- Verify the website’s security – Look for “https://” and a padlock icon in your browser’s address bar.

- Use secure networks – Never make payments on public Wi-Fi networks.

- Consider using a credit card – Credit cards offer fraud protection that debit cards may not.

- Check for PCI compliance – Legitimate payment processors will be PCI (Payment Card Industry) compliant.

- Create unique passwords – Use a strong, unique password for your collection agency portal.

How Online Debt Payments Affect Your Credit Score

Paying off collection debt can significantly impact your credit score, but the effects aren’t always immediate or straightforward:

- Newer credit scoring models (FICO 9, VantageScore 4.0) ignore paid collections completely.

- Older models still count paid collections but have a less negative impact than unpaid ones.

- Debt age matters – Paying off newer collections typically has a bigger positive impact than paying very old ones.

- Paid in full vs. settled – Some lenders look more favorably on debts paid in full rather than settled for less.

- Rapid rescoring – If you’re applying for a mortgage, ask your lender about rapid rescoring after paying collections.

Confirming Your Online Payment Was Processed

After making an online payment, take these steps to ensure proper processing:

- Request a “paid in full” letter – Keep this for your records.

- Monitor credit reports – Confirm updates.

- Dispute errors – File with credit bureaus if needed.

- Build positive credit – Use tools like debt payoff diagr

Handling Problems with Online Debt Payments

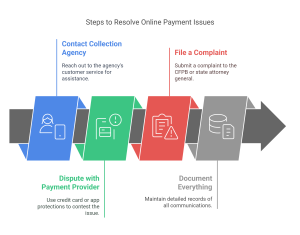

If something goes wrong with your online payment:

- Contact the collection agency – Most have customer service available through their website or by phone.

- Dispute with your payment provider – If using a credit card or payment app, you may have additional protections.

- File a complaint – If necessary, file a complaint with the CFPB or your state attorney general’s office.

- Document everything – Keep records of all communications about the issue.

After Paying Off Collection Debt Online

Once you’ve successfully paid off your collection debt, take these steps:

- Request a “paid in full” letter – Most agencies can provide this via email or their online portal.

- Monitor your credit reports – Check that the account status updates correctly.

- Dispute inaccuracies – If the collection isn’t marked as paid after 60 days, file disputes with the credit bureaus online.

- Build positive credit – Consider secured credit cards or credit-builder loans to establish a positive payment history.

FAQs About Paying Off Debt in Collections Online

Q: Can paying off debt in collections improve my credit score? A: Yes, paying off collections can improve your score, especially with newer scoring models that ignore paid collections entirely. Even with older models, a paid collection is better than an unpaid one.

Q: Are online payments to debt collection agencies safe? A: Yes, when using legitimate collection agency websites with proper security measures (HTTP, encryption, etc.). Always verify the agency’s legitimacy before making payments.

Q: Should I negotiate a debt settlement before paying online? A: If possible, yes. Many collection agencies are willing to accept less than the full amount, especially for older debts. Always get settlement agreements in writing before making any payments.

Q: What’s the fastest way to clear a debt that’s in collections online? A: The fastest method is typically paying via the collection agency’s website using a credit or debit card, which often processes immediately. However, verification that the debt is satisfied may take 30-60 days to appear on your credit report.

Q: Does paying the debt in collections remove it from my credit report? A: Paying the debt doesn’t automatically remove it from your credit report. The collection account will typically remain but show as “paid” status. It will naturally fall off your report seven years from the date of your first delinquency.

Take Control of Your Financial Future

Dealing with collection debt might feel overwhelming, but online payment options have made the process more manageable, private, and efficient than ever before. By following the steps outlined in this guide, you can resolve your collection debt safely and conveniently from home, putting yourself on the path to improved credit and financial stability.

Remember that every debt you successfully resolve is a step toward financial freedom. With each payment, you’re not just clearing old obligations—you’re opening doors to better financial opportunities in the future.

Ready to take action? Start by gathering information about your collection accounts, verifying their legitimacy, and exploring the online payment options each collector offers. Your future self will thank you for taking these important steps today.

Start your journey to financial freedom today at Wealthopedia—your guide to debt relief and smart financial decisions.