Key Takeaways

- Understand Your Financial Situation: Before negotiating, assess your income, expenses, and total debt to determine a realistic settlement offer.

- Know Your Rights: To avoid unfair treatment, familiarize yourself with consumer protection laws, such as the Fair Debt Collection Practices Act (FDCPA).

- Negotiate Strategically: Contact creditors directly, explain your hardship, and propose a lump-sum or structured settlement plan.

- Document Everything: Keep records of all conversations, agreements, and payment terms for future reference.

- Weigh the Pros and Cons of Debt Settlement Companies: While they can reduce debt, they often charge high fees and may impact your credit.

- Explore Alternative Solutions: Consider credit counseling, debt management plans, or professional financial advice before committing to settlement. Dealing with high-interest credit card debt can be overwhelming. However, with the proper preparation and strategies, you can negotiate directly with your creditors to reduce the total amount owed. This guide walks you through the process—from understanding the fundamentals of debt settlement to executing negotiation tactics—empowering you to take control of your financial future.

1. Introduction

The Challenge of Credit Card Debt

Credit card debt often feels insurmountable, especially when compounded by high interest rates and fees. Many individuals seek alternatives to traditional repayment methods, and negotiating a debt settlement may provide a viable path to financial relief.

What This Guide Offers

- Step-by-Step Instructions: Detailed guidance on negotiating settlements directly with credit card companies.

- Legal and Consumer Rights: Insights into legally stopping excessive payments and understanding your rights under U.S. law.

- Negotiation Strategies: Tactics for effective communication and handling counteroffers, including negotiating over live chat.

- Additional Resources: Links to reputable organizations for further information and assistance.

For additional consumer rights and debt management information, visit the Consumer Financial Protection Bureau (CFPB) and the Federal Trade Commission (FTC).

2. Understanding Credit Card Debt Settlement

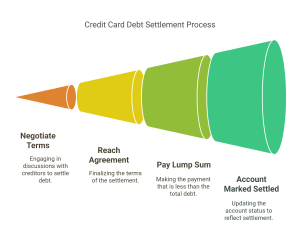

What Is Credit Card Debt Settlement?

Credit card debt settlement involves negotiating with your creditor to pay a lump sum less than the outstanding balance. Once an agreement is reached, the account is marked as “settled,” which may affect your credit score.

Key Considerations:

- Credit Impact: A settled account may initially lower your credit score but can ultimately provide a path to improved financial health.

- Legal Perspective: Settling your debt is legal when both parties agree on the terms. To learn more about your rights, consult resources like the FDCPA guidelines.

Credit Card Debt Settlement

How Debt Settlement Differs from Other Options

- Full Repayment vs. Settlement: Full repayment maintains a clean account history but may not be feasible in difficult financial times. Settlement offers a reduced lump sum payment.

- Negotiation vs. Default: Negotiating a settlement is a proactive approach that can prevent the severe consequences of defaulting on debt.

3. Preparing for Negotiation

Before initiating negotiations, conduct a thorough review of your finances:

Budget Analysis: Examine your monthly income, expenses, and outstanding debts to determine a realistic offer. Consider using a debt payoff diagram to map out your repayment plan.

Gather Documentation: Collect credit card statements, proof of income, and any records that demonstrate financial hardship. This documentation can strengthen your case during negotiations.

Develop a Debt Negotiation Plan

- Set Realistic Goals: Determine the minimum settlement amount you can afford while meeting your essential expenses.

- Know Your Rights: Familiarize yourself with U.S. consumer protection laws and the Fair Debt Collection Practices Act (FDCPA). This knowledge will give you confidence during negotiations.

Research Your Options

Decide whether to handle negotiations on your own or seek third-party assistance:

- Direct Negotiation: Saves money by avoiding fees associated with debt settlement companies.

- Professional Help: If you feel overwhelmed, credit counseling services can help you create a structured debt management plan. Learn more about professional services at the National Foundation for Credit Counseling (NFCC).

4. Strategies for Negotiating Credit Card Debt Settlement

Initiating Contact with Your Creditor

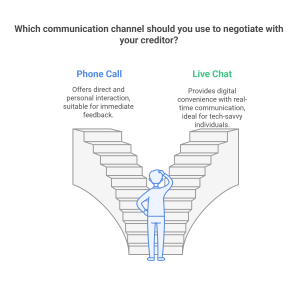

- Select Your Communication Channel: Many creditors offer multiple phone calls and live chat channels. If you prefer digital communication, consider negotiating over live chat.

- Prepare Your Script: Explain your financial hardship and why a reduced settlement is mutually beneficial. Mention that you are ready to negotiate a “credit card settlement offer” to resolve your debt.

Initiating Contact with Your Creditor

Key Negotiation Tactics

- Honesty and Professionalism: Transparency regarding your financial difficulties can help build trust. Use key phrases such as “settle credit card debt” and “debt negotiation” to steer the conversation.

- Propose a Settlement Offer: Clearly state the amount you can pay in a lump sum and ask if your creditor can accept that figure.

- Discuss Payment Terms: Consider flexible payment options, such as reduced interest rates or waived fees. This conversation may include terms like “credit card reduction” or “debt credit card settlement.”

Handling Counteroffers

- Maintain Patience: Negotiations can require several rounds of discussion. Remain calm and ask for time to review counteroffers.

- Document Every Conversation: Keep detailed records of each discussion, including dates, the names of representatives, and the specifics of any agreements reached.

5. Navigating the Negotiation Process

What to Expect

- Creditor Flexibility: While not every creditor will agree to a settlement, many prefer to negotiate rather than risk the consequences of a default.

- Legal and Financial Implications: Understand that settling your debt may have short-term impacts on your credit score and potential tax consequences. If you’re also managing accounts in collections, check how to pay off debt in collections online.

Frequently Asked Questions

- Will credit card companies work with you?

Many creditors are willing to negotiate if you present a well-documented case. - How can you settle credit card debt?

By clearly communicating your financial hardships and proposing a realistic settlement offer. - Is it possible to get out of credit card debt without paying anything?

While some sources may promise relief without payment, legitimate settlements typically require some form of reduced payment.

6. Legal Considerations and Risks

Staying Within Legal Boundaries

- Know the Law: Ensure your negotiation tactics comply with legal standards. This is crucial to exploring “how to stop paying credit cards legally.”

- Avoid Scams: Be wary of companies that guarantee debt relief without requiring payment. Verify the legitimacy of any advice by consulting reputable sources such as the FTC.

Potential Pitfalls

- Credit Score Impact: While settling your debt might lower your credit score in the short term, consider the benefits of reducing your overall debt burden.

- Future Borrowing: A settled debt can influence your ability to secure new credit until your financial profile improves.

7. Additional Resources and Alternatives

Credit Counseling and Debt Management Plans

- Benefits: Professional credit counseling services can negotiate on your behalf or help you establish a structured debt management plan.

- When to Consider: If direct negotiation feels too challenging or if you’re dealing with multiple creditors, professional assistance might be beneficial. More information is available at the NFCC website. Learn more about how to deal with debt.

Debt Settlement Companies

Overview:

Debt settlement companies specialize in negotiating with creditors on your behalf to reduce the total amount you owe. They typically work by asking you to stop making payments to your creditors and instead deposit funds into a dedicated account. Once a sufficient amount has accumulated, they negotiate lump-sum settlements for less than the entire balance. However, this approach comes with both advantages and risks.Pros and Cons of Debt Settlement Companies

✅ Pros:

✔ Potential for Significant Debt Reduction: Debt settlement companies often negotiate lower payoff amounts, sometimes reducing debts by 30% to 50% before fees.

✔ Structured Negotiation Process: Professionals handle negotiations, which can relieve stress and ensure a more strategic approach.

✔ Single Monthly Payment: You contribute to a dedicated account instead of managing multiple creditors, simplifying the repayment process.

✔ Avoid Bankruptcy: Settling debts may be a better alternative to bankruptcy, with long-term legal and credit consequences.

✔ Expertise in Debt Negotiation: These companies are experienced in handling difficult creditors and may secure better settlements than an individual could.

❌ Cons:

❌ High Fees: Companies charge significant fees—typically 15% to 25% of the enrolled debt—reducing overall savings.

❌ Credit Score Damage: Stopping payments as part of the settlement strategy can result in late fees, defaults, and severe credit score drops before settlement.

❌ No Guaranteed Results: Creditors are not obligated to settle; some may refuse to negotiate, leading to potential legal action.

❌ Lengthy Process: Settlements can take 24 to 48 months, during which late fees and interest accumulate.

❌ Potential for Lawsuits: Since payments are paused, creditors may take legal action, resulting in judgments or wage garnishment.

❌ Scams and Unethical Practices: Some companies engage in fraudulent practices, making it crucial to verify legitimacy through resources like the Better Business Bureau (BBB) and Federal Trade Commission (FTC).

Comparing Your Options: Quick Reference Table

Option Description Pros Cons Direct Negotiation Negotiate directly via phone or live chat No fees; direct communication with creditors Time-consuming; requires strong negotiation skills Debt Management Plan (DMP) Work with a credit counseling agency to structure repayment Professional guidance; structured repayment plan It may affect credit score, potential fees Debt Settlement Company Third-party negotiators specialized in debt settlements Expertise in negotiation; potential for significant reductions High fees, less control, potential scams Bankruptcy The legal process to discharge debts Can eliminate most debts; legal protection Long-term credit damage; significant legal and financial consequences 8. Conclusion

When you are well-prepared and informed, negotiating credit card debt settlement is a viable strategy. Here are the key takeaways:

- Preparation Is Essential:

Understand your financial situation, develop a realistic negotiation plan, and gather supporting documentation. - Effective Communication:

Whether via phone or live chat, remain honest and patient and keep detailed records of every conversation. - Know Your Options:

While direct negotiation can save money, alternative resources like credit counseling and professional debt settlement companies are available - Legal Awareness:

Always ensure that your actions comply with legal guidelines and be mindful of the potential impact on your credit score and future borrowing.

Taking charge of your financial future by negotiating your credit card debt settlement can pave the way toward economic stability and recovery. If you’re uncertain or require further assistance, consider consulting a financial advisor or legal professional.

For additional reading on credit card debt management and consumer rights, please visit:

- Consumer Financial Protection Bureau (CFPB)

- Federal Trade Commission (FTC)

- National Foundation for Credit Counseling (NFCC)

By following the steps outlined in this guide and utilizing the provided resources, you can confidently navigate the debt settlement process and work toward a more secure financial future.