KeyTake Away

- The blog reveals how a dedicated financial advisor for debt empowers clients to overcome challenges by creating personalized strategies and effective debt management plans, ensuring sustainable progress.

- It explains that advisors perform comprehensive assessments, strategic planning, and expert creditor negotiations to break the debt cycle and reduce financial stress for lasting stability.

- Emphasizing financial literacy and ongoing education, the blog shows that proactive debt management improves credit scores and fosters long-term financial stability, leading to success.

- Ultimately, readers are urged to engage trusted professionals, prepare key financial documents, and take decisive steps toward transforming their financial future while building resilience.

You’re sitting at your kitchen table, surrounded by a sea of bills, credit card statements, and loan notices. Each piece of paper feels like a weight pressing down on your shoulders, creating a suffocating sense of financial uncertainty. The numbers blur together, and the anxiety builds with each passing moment. This is a scenario countless Americans face daily – a financial maze that seems impossible to navigate.

But what if there was a professional guide who could help you not just survive but thrive? Enter the debt management financial advisor – part strategist, part financial therapist, and entirely committed to helping you reclaim your financial independence.

Understanding Debt Management: More Than Just Number Crunching

What is a Debt Management Financial Advisor?

A debt management financial advisor is far more than a simple number cruncher or spreadsheet expert. They are strategic partners who bring a holistic approach to your financial health. Think of them as personal financial physicians, diagnosing the root causes of your debt challenges and prescribing comprehensive treatment plans.

Their toolkit is extensive and nuanced:

- Comprehensive Financial Assessment: They conduct deep-dive analyses of your entire financial ecosystem

- Strategic Planning: Develop personalized roadmaps for debt reduction and financial stability

- Emotional Support: Provide guidance that goes beyond spreadsheets, understanding the psychological burden of financial stress

- Ongoing Education: Teach sustainable financial habits that prevent future debt accumulation

The Multifaceted Role of a Debt Management Advisor

Debt Landscape Navigation

Every financial journey is unique, prompting advisors to meticulously analyze your current debt portfolio, identify high-interest debt traps, explore options like debt consolidation, and create customized repayment strategies.

- Meticulously analyze your current debt portfolio

- Identify high-interest debt traps

- Explore debt consolidation possibilities

- Create customized repayment strategies

Creditor Negotiation: The Hidden Superpower

Financial advisors excel as negotiators, communicating directly with creditors to potentially reduce interest rates, set manageable payment plans, and negotiate settlements. Learn more about negotiating credit card debt settlements yourself.

- Communicate directly with creditors

- Potentially reduce interest rates

- Establish more manageable payment plans

- Negotiate potential debt settlements

Credit Score Rehabilitation

Beyond immediate debt management, these professionals help you rebuild your most important financial asset: your credit score. They provide:

- Strategic credit repair advice

- Guidance on responsible credit usage

- Long-term credit health strategies

Qualifications: Choosing Your Financial Ally

Not all debt management advisors are created equal. When selecting your financial partner, consider these critical qualifications:

| Qualification | Significance | What to Look For |

| Certified Financial Planner (CFP) | Demonstrates rigorous professional training | Comprehensive financial planning education |

| Specialized Debt Management Credentials | Indicates deep expertise in debt resolution | Additional certifications beyond basic financial planning |

| Proven Track Record | Shows real-world success | Client testimonials, case studies, success rates |

| Regulatory Compliance | Ensures legal and ethical practices | Knowledge of U.S. financial regulations |

Navigating U.S. Financial Protections

The United States offers robust consumer protection mechanisms for individuals seeking financial advice. Your debt management advisor must:

- Adhere to strict ethical guidelines set by financial regulatory bodies

- Maintain complete transparency in all recommendations

- Comply with federal and state financial regulations

- Protect your personal and financial information

Financial Investment: Understanding Fee Structures

A skilled advisor helps reconstruct your entire financial foundation, providing benefits such as:

- Credit Score Improvement: Strategic interventions may boost your credit score by 50-100 points in 6-12 months.

- Stress Reduction: Professional guidance significantly alleviates anxiety.

- Long-Term Financial Planning: Beyond immediate debt relief, advisors also assist with long-term strategies for retirement and investments.

- Flat Fee Arrangements

- Predictable costs

- Typically used for straightforward debt scenarios

- Ranges from $500 to $2,500 depending on complexity

- Percentage-Based Pricing

- Fee calculated as a percentage of total debt or savings achieved

- Incentivizes advisor to maximize your financial recovery

- Typically, 15-25% of total debt or projected savings

- Hourly Consultation Rates

- Flexible option for targeted advice

- Rates range from $100 to $300 per hour

- Best for specific, short-term guidance needs

Real-World Impact: Transformative Potential

A skilled financial advisor doesn’t just help you manage debt – they help you reconstruct your entire financial foundation. Potential transformative benefits include:

- Credit Score Improvement

- Strategic interventions can help rebuild credit

- Potential increase of 50-100 points within 6-12 months

2. Stress Reduction

- Professional guidance alleviates financial anxiety and provides clear, actionable strategies.

3. Long-Term Financial Planning

- Beyond debt management, advisors help set future financial goals

- Retirement planning

- Investment strategy development

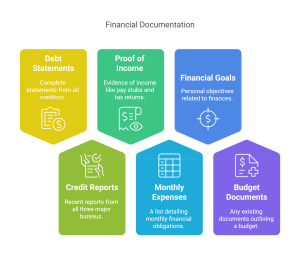

Preparing for Your First Consultation: A Comprehensive Checklist

To maximize your initial meeting, gather:

- Complete debt statements from all creditors

- Recent credit reports (from all three major bureaus)

- Proof of income (pay stubs, tax returns)

- List of monthly expenses

- Personal financial goals

- Any existing budget documents

Common Misconceptions About Debt Management

Myth: Debt Management is Only for Those in Extreme Financial Distress

Reality: Proactive debt management can benefit individuals at various financial stages, from those facing challenges to those seeking optimization.

Myth: Financial Advisors are Too Expensive

Reality: The cost of professional guidance is often offset by potential savings and financial recovery strategies.

Call to Action: Your Financial Transformation Starts Now

Your financial future is not predetermined. It’s a path you can actively shape with the right guidance, strategy, and commitment. A debt management financial advisor can be the catalyst for your financial transformation.

Take the First Step:

- Research qualified debt management advisors

- Schedule initial consultations

- Prepare your financial documents

- Be open, honest, and committed to change

Share Your Journey:

Disclaimer: This article provides general information and should not be considered direct financial advice. Always consult with a certified financial professional for personalized guidance tailored to your specific situation.

Discover more about strategic debt management at Wealthopedia—Your partner in building financial resilience!