Introduction

Drowning in debt feels like swimming against a relentless current. I’ve been there—watching bills pile up while the minimum payments barely make a dent in what I owe. If you’re nodding along, you’re not alone. Millions of Americans wake up each day carrying the weight of financial obligations that seem impossible to overcome.

But here’s the thing: debt doesn’t have to be a life sentence.

Today, I’m diving into the world of debt relief programs—real solutions that have helped countless people regain their financial footing. Whether you’re dealing with credit card debt that’s spiraled out of control, medical bills that arrived unexpectedly, or student loans that refuse to disappear, understanding your options is the first step toward financial freedom.

Let’s break down the maze of debt relief programs available to you right here in the United States.

Understanding Your Debt Relief Options

When financial hardship strikes, knowing which path to take can mean the difference between sinking deeper and finding solid ground. But not all debt relief programs are created equal, and what works for your neighbor might not work for you.

Debt Management Plans (DMPs): A Structured Approach

A Debt Management Plan might be your lifeline if you’re juggling multiple credit card payments. Here’s how it works:

You’ll partner with a nonprofit credit counseling organization that will work as an intermediary between you and your creditors. They’ll negotiate lower interest rates and consolidated monthly payments that fit your budget. Instead of making separate payments to each creditor, you’ll make one payment to the counseling agency, which distributes the funds to your creditors.

“Working with a credit counselor gave me structure and accountability,” says Mark from Ohio. “My interest rates dropped from 24% to 8%, and I could finally see the light at the end of the tunnel.”

Benefits of a DMP:

- Simplified monthly payments

- Reduced interest rates

- Fixed repayment timeline (typically 3-5 years)

- Protection from collection calls

Things to consider:

- You’ll likely need to close credit accounts

- May appear on your credit report (though not negatively)

- Usually requires a small monthly fee

- Not all types of debt qualify (mainly unsecured debts)

Debt Consolidation Loans: Simplifying Your Payments

Imagine replacing all those high-interest credit cards with a single, lower-interest loan. That’s the premise behind debt consolidation, and it can be a game-changer for your monthly budget and peace of mind.

Consolidation works by combining multiple debts into one new loan, ideally with a lower interest rate. This can come from a bank, credit union, or online lender in the form of a personal loan, home equity loan, or balance transfer credit card.

When consolidation makes sense:

- Your credit score is good enough to qualify for a lower rate

- You have a stable income to make regular payments

- You’re committed to not accumulating more debt

- You prefer a structured repayment plan

I personally used a debt consolidation loan after my divorce when I had accumulated debt across five different credit cards. Combining everything into one payment not only saved me money on interest but also removed the stress of juggling multiple due dates.

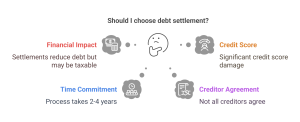

Debt Settlement: Negotiating Down What You Owe

Sometimes the most direct approach is simply negotiating with creditors to accept less than what you owe. Debt settlement can be a viable option if you’re significantly behind on payments or facing financial hardship that prevents full repayment.

Here’s where things get interesting: you can handle settlement yourself or work with a debt settlement company. If you go the professional route, the company typically has you stop making payments to creditors and instead deposit money into a dedicated account. Once enough funds accumulate, they negotiate with creditors to settle debts for less than the full amount.

The reality check:

- Settlements typically range from 40-60% of original balances

- Your credit score will take a significant hit

- Forgiven debt over $600 may be considered taxable income

- The process can take 2-4 years to complete

- Not all creditors will agree to settlements

Bankruptcy: The Legal Fresh Start

When other options aren’t viable, bankruptcy provides a legal process to either eliminate or repay debt under court protection. While often viewed as a last resort, bankruptcy can be the most appropriate solution for those with overwhelming debt and limited income.

There are two primary types for individuals:

Chapter 7 Bankruptcy (Liquidation)

- Eliminates most unsecured debts

- Process typically takes 3-6 months

- May require selling some assets

- Remains on credit report for 10 years

- Income must be below your state’s median

Chapter 13 Bankruptcy (Reorganization)

- Creates a 3-5 year repayment plan

- Allows you to keep assets while repaying

- Remains on credit report for 7 years

- Requires regular income

- Has debt limits ($419,275 unsecured, $1,257,850 secured as of 2021)

Filing bankruptcy requires legal assistance, and the protection it offers is significant—once filed, the “automatic stay” stops collection activities immediately.

Hardship Programs: Direct Relief from Creditors

Did you know many creditors offer their own hardship programs? These aren’t widely advertised, but they exist for customers facing temporary financial difficulties due to circumstances like job loss, medical emergencies, or natural disasters.

Hardship programs might include:

- Temporarily reduced interest rates

- Lower monthly payments

- Waived fees

- Extended payment timelines

- Interest-only payments for a period

The key is reaching out proactively before you fall behind. I’ve found that a simple, honest phone call explaining your situation can unlock options you didn’t know existed.

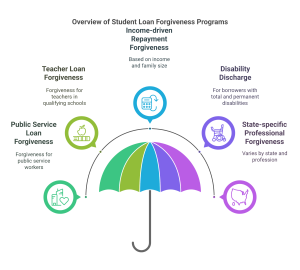

Loan Forgiveness Programs: Wiping the Slate Clean

Some types of debt—particularly federal student loans—may qualify for forgiveness programs based on your profession, service, or repayment history.

Common forgiveness programs include:

- Public Service Loan Forgiveness (PSLF)

- Teacher Loan Forgiveness

- Income-driven repayment forgiveness

- Disability discharge

- State-specific professional forgiveness programs

While forgiveness sounds ideal, each program has specific eligibility requirements and timelines, often requiring years of qualifying payments or service.

Choosing the Right Debt Relief Option for You

With so many paths forward, how do you know which debt relief program fits your situation? Here’s a simple framework to help you decide:

| Debt Relief Option | Best For | Impact on Credit | Timeline | Cost |

| Debt Management Plan | Multiple credit card debts | Minimal negative impact | 3-5 years | Monthly fee ($25-$75) |

| Debt Consolidation | Good credit, multiple high-interest debts | Initial small drop, then positive | Varies (typically 2-7 years) | Loan fees, interest |

| Debt Settlement | Significant financial hardship, behind on payments | Severe negative impact | 2-4 years | 15-25% of enrolled debt |

| Bankruptcy Chapter 7 | Overwhelming debt, limited income, few assets | Severe negative impact | 3-6 months | $1,500-$3,000 in legal fees |

| Bankruptcy Chapter 13 | Regular income, want to keep assets | Significant negative impact | 3-5 years | $3,000-$5,000 in legal fees |

| Hardship Programs | Temporary financial difficulty | Minimal impact if payments made | Varies (typically 6-12 months) | Usually free |

| Loan Forgiveness | Specific loan types (mainly federal student loans) | None | Varies (often 5-25 years) | Free |

The most important factors to consider include:

- Your total debt amount

- Types of debt you have

- Your current and projected income

- How quickly you need relief

- How important your credit score is to your future plans

- Whether your financial hardship is temporary or long-term

Working with Professionals: Who Can Help?

Navigating debt relief isn’t something you have to do alone. Several types of professionals specialize in helping people overcome financial challenges:

Credit Counselors

Nonprofit credit counseling organizations offer free or low-cost guidance on managing finances and debt. They can help you:

- Create a budget

- Understand your options

- Set up a debt management plan

- Develop financial literacy

When choosing a counselor, look for accreditation by the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA).

Legal Advisors

Bankruptcy attorneys specialize in guiding clients through the legal process of bankruptcy. They:

- Determine if bankruptcy is appropriate

- Advise on which chapter to file

- Handle paperwork and court appearances

- Protect you from creditor violations

For bankruptcy, working with an attorney isn’t just helpful—it’s nearly essential for navigating the complex legal requirements.

Debt Settlement Companies

If you’re considering debt settlement, companies in this space will:

- Evaluate your debt situation

- Create a savings plan for settlement funds

- Negotiate with creditors on your behalf

Caution is warranted here—the debt settlement industry has seen its share of scams. Always verify a company is registered in your state and check their BBB rating before proceeding.

Protecting Yourself: Red Flags and Regulatory Safeguards

As you explore debt relief options, keep an eye out for these warning signs of potential scams:

- Upfront fees before any services are provided

- Guarantees to eliminate all your debt

- Directions to stop communicating with creditors without legal protection

- Promises of “new government programs” to bail out personal debt

- High-pressure sales tactics

- Reluctance to provide written information

Remember that legitimate debt relief services must follow regulations enforced by government agencies like the Federal Trade Commission (FTC) and the Consumer Financial Protection Bureau (CFPB). These organizations work to ensure debt relief providers:

- Disclose all terms, conditions, and costs before you enroll

- Allow you to cancel services without penalty within a specified timeframe

- Make accurate representations about their services

- Follow specific rules about when and how they can collect fees

If you encounter a company violating these rules, report them to the FTC or your state’s attorney general office.

Beyond Debt Relief: Building Financial Resilience

Getting out of debt is a major accomplishment, but staying out of debt requires a shift in financial habits. As someone who’s been through this journey, I can tell you that these practices make all the difference:

- Emergency Fund First: Before accelerating debt payoff, build a small emergency fund (aim for $1,000 initially) to prevent new debt from unexpected expenses.

- Realistic Budgeting: Create a budget that accounts for occasional splurges—overly restrictive plans often fail.

- Income Expansion: Look for ways to increase your income, even temporarily, through side gigs, selling unused items, or negotiating a raise.

- Financial Education: Invest time in learning about personal finance through books, podcasts, or community workshops.

- Accountability Partners: Share your goals with someone who can help keep you on track.

FAQs About Debt Relief Programs

Will debt relief hurt my credit score? Most debt relief options will impact your credit, with bankruptcy and debt settlement causing the most significant drops. Debt management plans have minimal impact if payments are made on time, while consolidation may cause a small initial dip followed by improvement as you make regular payments.

How long does it take to rebuild credit after debt relief? Recovery times vary based on the method used and your subsequent financial behavior. Expect 2-3 years of consistent, positive credit activity to see substantial improvement after debt settlement or bankruptcy. After debt management or consolidation, recovery can begin within 12 months.

Can I handle debt settlement myself instead of hiring a company? Absolutely! DIY debt settlement involves contacting creditors directly, explaining your hardship, and offering a lump-sum payment that’s less than the full balance. The key is getting any agreement in writing before sending payment.

Are debt relief services tax-deductible? Generally no, though bankruptcy attorney fees may be deductible in some cases. Consult a tax professional, as this depends on your specific situation.

Will I lose my home if I file for bankruptcy? Not necessarily. Chapter 13 bankruptcy specifically allows you to keep assets while repaying debts. Even in Chapter 7, homestead exemptions protect equity in your primary residence up to certain limits, which vary by state.

What types of debt cannot be eliminated through bankruptcy? Certain debts typically survive bankruptcy, including:

- Most student loans

- Recent tax obligations

- Child support and alimony

- Court-ordered restitution

- Debts incurred through fraud

How do I know if a credit counseling agency is legitimate? Look for accreditation by the NFCC or FCAA, check for complaints with the Better Business Bureau, and verify they’re a non-profit organization with reasonable fees.

Conclusion

Debt relief isn’t just about eliminating financial obligations—it’s about reclaiming your peace of mind and building a foundation for future financial success. The journey may not be easy, but with the right program and commitment, you can transform your relationship with money.

I’ve seen firsthand how the weight lifts when you find the right solution. Whether it’s the structure of a debt management plan, the simplicity of consolidation, the fresh start of bankruptcy, or the negotiations of settlement, the key is taking that first step.

Your financial story isn’t defined by where you are today, but by the decisions you make going forward. Reach out to a credit counselor, consult with a legal advisor, or call your creditors directly—just don’t wait until your options narrow.

What debt relief step will you take this week? Your future self will thank you for starting now.