Picture this: You’re scrolling through mortgage rates online, and your heart sinks when you see the difference between “good credit” and “fair credit” interest rates. That extra 2% could cost you thousands of dollars over the life of your loan. Sound familiar?

If you’re sitting around a 620-640 credit score right now, I’ve got some incredible news for you. Getting to that magical 700 credit score isn’t just a pipe dream—it’s absolutely achievable in 90 days if you know exactly what moves to make.

I’m about to share the exact roadmap that has helped thousands of people transform their credit scores from “meh” to “magnificent” in just three months. No expensive credit repair services. No sketchy shortcuts. Just proven strategies that actually work.

Why 700 Is the Golden Number You Need to Hit

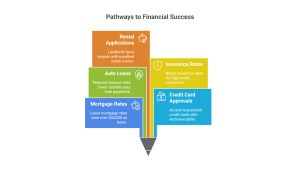

Before we dive into the how-to, let’s talk about why reaching a 700 credit score is such a game-changer:

- Mortgage rates: You’ll qualify for the best rates, potentially saving $50,000+ over a 30-year loan

- Credit card approvals: Premium cards with amazing perks become accessible

- Auto loans: Lower interest rates mean lower monthly payments

- Insurance rates: Many insurers offer better rates to high-credit customers

- Rental applications: Landlords prefer tenants with excellent credit

The Brutal Truth: Can You Really Hit 700 in 90 Days?

Let’s be real for a second. Can you really raise your credit score to 700 in just 90 days?

The honest answer depends on where you’re starting from:

✅ Highly Likely (Current Score 650-680):

- You have an established credit history

- No major derogatory marks

- Primary issues are high utilization or minor errors

⚠️ Possible But Challenging (Current Score 600-649):

- Multiple negative items may slow progress

- Focus on realistic 50-100 point gains initially

- May take 4-6 months to reach 700

❌ Unrealistic (Current Score Below 600):

- Severe credit damage takes time to heal

- Set initial goal of reaching 650, then work toward 700

The key is being honest about your starting point and focusing on the strategies that will give you the biggest bang for your buck.

Your 90-Day Credit Score Action Plan

Days 1-7: The Foundation Phase

Day 1: Get Your Free Credit Reports

Start by pulling your credit reports from all three bureaus through AnnualCreditReport.com (the official government-authorized site). Don’t just look at one—each bureau might have different information.

Day 2-3: Audit for Errors

Look for these common mistakes that could be dragging down your score:

- Accounts that aren’t yours

- Incorrect payment histories

- Wrong account balances

- Duplicate accounts

- Accounts showing as open when they’re closed

Day 4-5: Calculate Your Current Utilization

This is huge. Credit utilization accounts for 30% of your credit score. Here’s the math:

Card | Credit Limit | Current Balance | Utilization % |

Card A | $5,000 | $3,500 | 70% |

Card B | $2,000 | $400 | 20% |

Total | $7,000 | $3,900 | 56% |

If your utilization is above 30%, this becomes your #1 priority.

Day 6-7: Set Up Automatic Payments

Late payments are credit score killers. Set up automatic minimum payments for all accounts to ensure you never miss a due date. This simple step can prevent devastating 60-100 point score drops.

Insert image of credit report audit checklist

Days 8-30: The Aggressive Attack Phase

Week 2: Dispute Errors Like a Pro

File disputes with all three credit bureaus for any errors you found. Here’s the insider trick: Be specific and provide documentation. Don’t just say “This is wrong”—explain exactly what’s incorrect and why.

The dispute process typically takes 30 days, but I’ve seen corrections happen in as little as 15 days. Your score can jump overnight once errors are removed.

Week 3-4: The Utilization Blitz

This is where you’ll see the most dramatic improvements. Your goal is to get below 10% utilization on all cards. Here’s how:

- Pay down high-utilization cards first: If you have a card at 70% utilization, paying it down to 30% will have more impact than paying off a card already at 20%

- Consider balance transfers: Moving debt from a high-utilization card to one with available credit can instantly improve your score

- Ask for credit limit increases: Call your credit card companies and request increases. This immediately lowers your utilization percentage

- Make multiple payments per month: Instead of one monthly payment, make weekly payments to keep balances low

For those dealing with overwhelming debt, consider exploring nonprofit debt consolidation options that can help streamline your payments while you work on improving your score.

Days 31-60: The Optimization Phase

Become an Authorized User

Ask a family member with excellent credit to add you as an authorized user on their oldest, lowest-utilization card. This can add years to your credit history and improve your utilization overnight.

Open a Secured Credit Card (If Needed)

If you have a limited credit history, a secured card can help build a positive payment history. Use it for small purchases (think: Netflix subscription) and pay it off immediately.

Strategic Credit Inquiries

Avoid applying for new credit during this period unless absolutely necessary. Each hard inquiry can temporarily drop your score by 5-10 points.

If you must shop for loans, do all your rate shopping within a 14-45 day window so multiple inquiries count as one.

Days 61-90: The Fine-Tuning Phase

Monitor Weekly Changes

Use free services like Credit Karma or Experian to track your progress weekly. This helps you see which strategies are working best.

Pay Attention to Statement Dates

Here’s a little-known secret: when you pay matters. Most credit card companies report your balance on your statement date, not your due date.

Try to pay down balances before your statement closes to show lower utilization on your credit report.

Consider Professional Help

If you’re struggling with multiple collections or complex credit issues, certified nonprofit credit counselors can be invaluable. The best free credit counseling services can help you navigate disputes and negotiate with creditors.

The Numbers Game: What to Expect Each Month

Here’s a realistic timeline based on starting with a 640 credit score:

Timeframe | Expected Score Range | Key Actions |

Week 1-2 | 640-650 | Error disputes filed, utilization calculated |

Month 1 | 650-675 | Errors removed, utilization lowered to 30% |

Month 2 | 675-690 | Utilization below 10%, payment history improving |

Month 3 | 690-710 | Fine-tuning and optimization |

Remember, credit scores can change overnight when positive changes are reported, but they can also take 30-60 days to reflect improvements.

Common Mistakes That Will Sabotage Your Progress

Mistake #1: Closing Old Credit Cards

Even if you’re not using that old card, keep it open! It’s contributing to your length of credit history (15% of your score) and total available credit. Canceling credit cards can hurt your credit more than you think.

Mistake #2: Paying Off Collections Without Negotiating

Before you pay that old collection account, try to negotiate a “pay-for-delete” agreement. Simply paying it off doesn’t remove it from your report—you need it deleted entirely.

Mistake #3: Applying for Multiple Credit Cards

I get it—you want to increase your available credit. But multiple applications in a short period can seriously damage your score. Be strategic and space out applications.

Mistake #4: Ignoring Different Types of Credit

Your credit mix matters. Having both revolving credit (credit cards) and installment loans (auto loans, mortgages) shows lenders you can handle different types of debt responsibly.

Advanced Strategies for Maximum Impact

The “15/3 Payment Method”

Make your credit card payment 15 days before your due date, then make another small payment 3 days before the due date. This keeps your utilization ultra-low and can boost your score faster.

Rent Reporting Services

Services like RentTrack or PayYourRent can add your on-time rent payments to your credit report, giving you an additional positive payment history.

Credit Builder Loans

These unique loans are designed specifically to build credit. You make payments into a savings account, and once it’s paid off, you get the money back—plus improved credit.

Your Emergency Action Plan for Different Scenarios

Scenario 1: You Have Multiple Late Payments

- Focus on bringing all accounts current immediately

- Set up automatic payments to prevent future lates

- Consider a financial advisor for debt management

Scenario 2: High Credit Card Debt

- List all cards by utilization percentage

- Attack the highest utilization first

- Consider a personal loan for debt consolidation

- Explore ways to save money on a tight budget to free up cash for payments

Scenario 3: Limited Credit History

- Become an authorized user on a family member’s account

- Open a secured credit card

- Consider alternative credit-building options

Frequently Asked Questions

How quickly do disputes improve my score?

Once a bureau verifies an error and removes it, your score can rebound within a week—sometimes overnight. Most disputes are resolved within 30 days, but some clear in 15-20 days.

What’s the ideal credit utilization percentage?

Aim for below 30% immediately, but target below 10% for maximum score benefits. For example, on a $5,000 limit card, keep balances under $500.

Should I close old credit cards I’m not using?

No! Even zero-balance cards contribute to your credit history length and total available credit. If there’s an annual fee, consider downgrading to a no-fee version instead.

How many hard inquiries can I have without hurting my score?

Ideally, avoid more than one new inquiry during your 90-day window. Multiple inquiries can cost 5-10 points each. When shopping for loans, keep rate-shopping within a 14-45 day window.

Will paying off a collection account increase my score immediately?

Only if you negotiate a “pay-for-delete” arrangement. Simply paying it shows “paid” but may not improve your score significantly.

Tools and Resources to Track Your Progress

Free Credit Monitoring:

- Credit Karma (weekly updates)

- Experian (monthly FICO score)

- Capital One CreditWise

- Chase Credit Journey

Paid Options:

- MyFICO (all three bureau scores)

- Identity Guard

- PrivacyGuard

Mobile Apps:

- Credit Sesame

- WalletHub

- Mint (includes credit score tracking)

The Long-Term Maintenance Plan

Reaching 700 is just the beginning. Here’s how to maintain and continue improving:

Monthly Tasks:

- Check credit reports for new errors

- Keep utilization below 10%

- Pay all bills on time

Quarterly Tasks:

- Review credit card statements for accuracy

- Consider requesting credit limit increases

- Evaluate the need for new credit products

Annual Tasks:

- Pull full credit reports from all three bureaus

- Review and update automatic payments

- Assess overall debt reduction strategies

Your Action Steps Starting Today

Ready to transform your credit score? Here’s exactly what to do right now:

- Today: Pull your free credit reports from AnnualCreditReport.com

- This Week: Audit for errors and calculate current utilization

- Next Week: File disputes and start paying down high-utilization cards

- This Month: Implement the utilization blitz strategy

- Ongoing: Monitor progress weekly and stay consistent with payments

Remember, improving your credit score is a marathon, not a sprint. But with the right strategy and consistent effort, that 700 credit score is absolutely within your reach.

The difference between where you are now and where you want to be isn’t luck—it’s knowledge and action. You have the knowledge. Now it’s time to take action.

Ready to start your credit transformation journey? Share this guide with someone who needs it, and drop a comment below with your current credit score goal. Let’s celebrate your wins together as you work toward that 700 milestone!

For More Info Explore Now!!

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Individual results may vary based on credit history and financial circumstances. Always consult with qualified financial professionals before making major financial decisions.